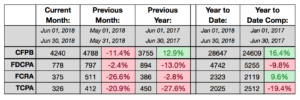

There is a lot of red in the monthly chart published by WebRecon highlighting the number of lawsuits filed against collection agencies alleging violations of the Fair Debt Collection Practices Act, the Telephone Consumer Protection Act, and the Fair Credit Reporting Act and also including data about the number of collection-related complaints filed with the Bureau of Consumer Financial Protection, and that should have the industry seeing green pastures for the future.

On a month-over-month basis, the number of lawsuits filed against collection agencies dropped from 1,710 in May to 1,470 in June. The number of FCRA suits had the largest drop, falling to 375 in June, from 511 in May.

On a year-over-year basis, the number of FDCPA lawsuits is down nearly 10% through the first half of 2018 compared with 2017, and the number of TCPA lawsuits is down 19%. The number of FCRA lawsuits is up 9.6% from a year ago.

“After several years of aggressive growth, TCPA just has not been able to sustain its numbers this year, a fact that should bring some (albeit minor) relief to the long-beleaguered collection and marketing verticals that have been targeted by relentless class actions invoking that statute,” wrote Jack Gordon, the chief executive of WebRecon, in a release.