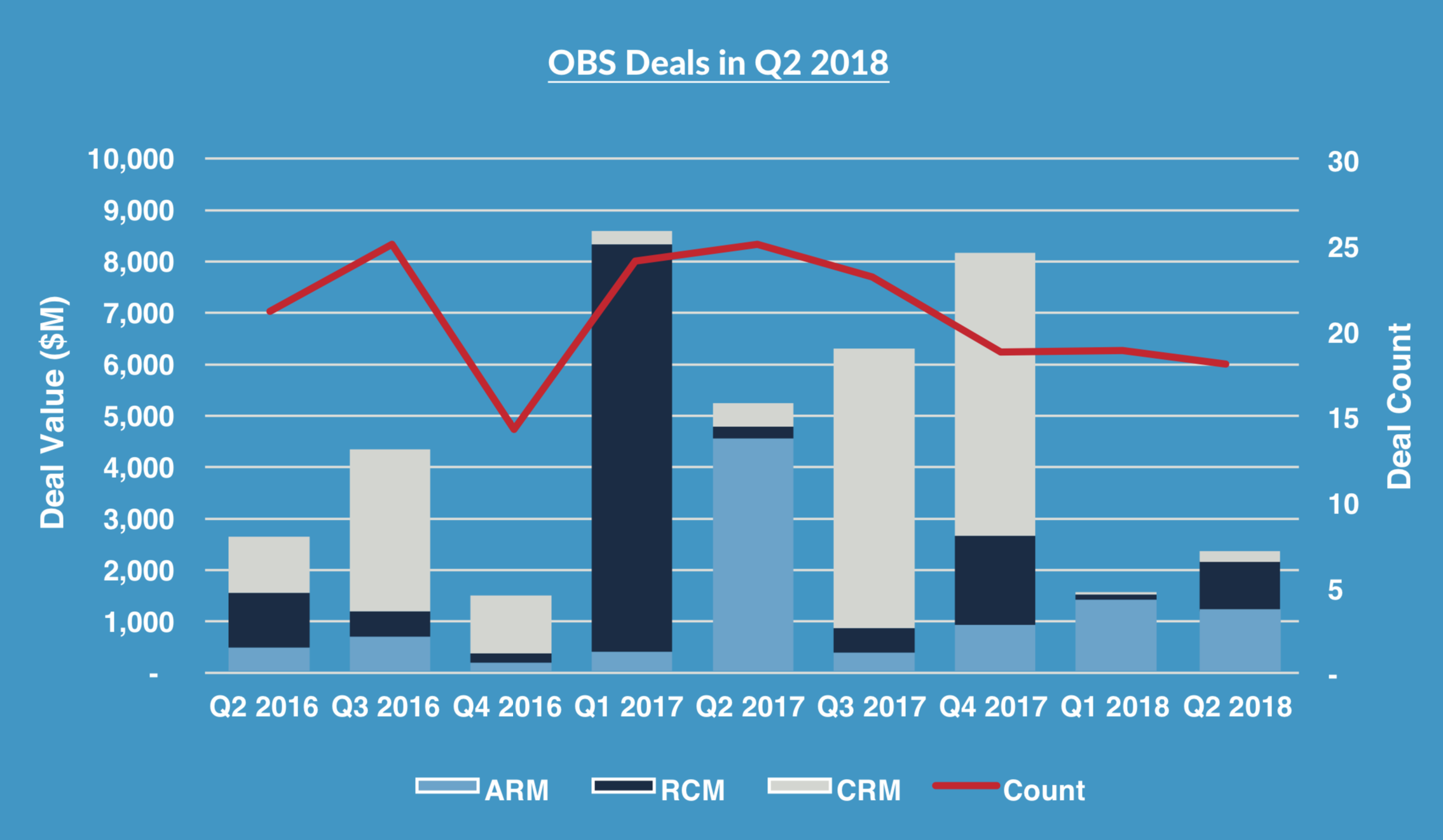

The ARM industry had its second-straight billion-dollar quarter, in terms of total dollar value of merger & acquisition deals, according to data released yesterday by Corporate Advisory Solutions, a boutique merchant bank servicing the collection and debt-buying industry.

There were 11 deals struck during the second quarter of the year, representing $1.16 billion in deal value, according to CAS. That compares with 10 deals worth $1.4 billion during the first quarter of the year. Prior to this year, the ARM sector had only had one billion-dollar quarter in the past three years, according to CAS.

The company said it is seeing “increased interest in the ARM industry,” especially from investment firms. More interest and activity from investment firms, such as private equity companies, is expected to continue in the ARM space, CAS said.

The company said it is seeing “increased interest in the ARM industry,” especially from investment firms. More interest and activity from investment firms, such as private equity companies, is expected to continue in the ARM space, CAS said.

On the revenue cycle management side of the industry, rising healthcare costs continue to drive interest in acquiring companies that manage payments and collections for doctors, medical practices, and hospitals.

There were five M&A deals in the space in the second quarter, representing $987 million in value, according to CAS. Those numbers are expected to remain strong for the foreseeable future, the company said.