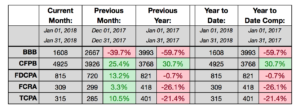

While not as high as they were a year ago, the number of lawsuits alleging violations of the Fair Debt Collection Practices Act, the Fair Credit Reporting Act, and the Telephone Consumer Protection Act were all higher in January than they were in December, according to data released yesterday by WebRecon.

The number of FCRA and TCPA lawsuits were each down by more than 20% on a year-over-year basis, while the number of FDCPA lawsuits was down about 1%. On a month-over-month basis, however, the number of FCRA lawsuits was up 3%, while the number of FDCPA and TCPA suits were up by at least 10% each. The number of FDCPA complaints was at its highest point in six months, according to WebRecon.

As well, there was a marked spike in the number of complaints filed with the Consumer Financial Protection Bureau in January. The 4,925 that were filed were 25% higher than the total filed in December and 31% higher than the total filed in the same month last year. The 4,925 complaints was the most ever submitted to the CFPB in a given month, and was nearly 10% higher than the previous high, which was set in August 2017.

As well, there was a marked spike in the number of complaints filed with the Consumer Financial Protection Bureau in January. The 4,925 that were filed were 25% higher than the total filed in December and 31% higher than the total filed in the same month last year. The 4,925 complaints was the most ever submitted to the CFPB in a given month, and was nearly 10% higher than the previous high, which was set in August 2017.

More than one-third of all lawsuit filers had previously filed a suit against a collection agency, according to WebRecon.