Compliance Digest – November 25

Every week, AccountsRecovery.net brings you the most important news in the industry.…

Judge Denies MTD in FDCPA Case Over Judgment Letter Sent to Wrong Address

A District Court judge in Ohio has denied a defendant's motion to…

Report: State, Counties Really Inefficient at Collecting Court Debt

States and local governments should stop eliminate court-imposed fees, create sliding scales…

Pai: FCC Working on Regs For Carriers Not Moving Fast Enough on SHAKEN/STIR

Not necessarily content with how quickly mobile phone carriers are implementing call…

Judge Grants Plaintiff’s Motion for Judgment in FDCPA Counterclaim Over Collector Identification in Letter

A District Court judge in Ohio has denied a collection agency's motion…

Industry Lines Up Behind Facebook in Fight to Alter Ninth Circuit’s Definition of ATDS

ACA International, along with Midland Credit Management and Encore Credit filed amicus…

Judge Grants MTD in FDCPA Case Alleging Overshadowing in Collection Letter

A District Court judge in New York has granted a defendant's motion…

TCPA Class Action Alleges Unsolicited Calls Pitched Debt Consolidation Services

A class-action lawsuit has been filed, accusing a financial services company and…

Momentum for Federal Privacy Bill Picking Up Steam

The top Democrats from four key Senate committees have come together to…

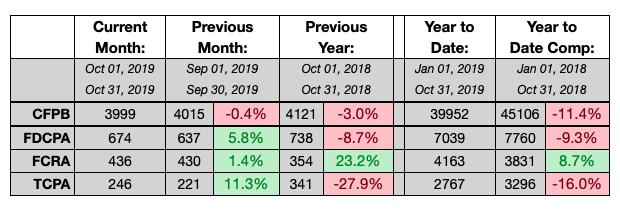

Lawsuit Totals Rise in October: WebRecon

There was an uptick in the number of lawsuits filed in October…