The Court of Appeals for the Seventh Circuit has upheld summary judgment in favor of a furnisher in a Fair Credit Reporting Act case that was accused of providing inaccurate information after conducting an unreasonable investigation of the plaintiff’s dispute, ruling that “no reasonable jury could find” that the furnisher “provided patently incorrect or materially misleading information.”

A copy of the ruling in the case of Frazier v. Dovenmuehle Mortgage can be accessed by clicking here.

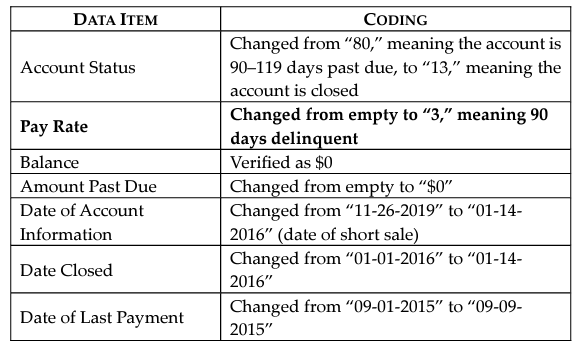

The plaintiff fell behind on her mortgage payments and settled the debt through a short sale of her home, which occurred in January 2016. In 2019 and 2020, the plaintiff noticed the account was being reported as delinquent on her credit report, so she filed a dispute with the credit reporting agencies. One of the credit reporting agencies sent the defendant four ACDV forms, and in response to those disputes, the defendant made several changes to the information it was furnishing to the credit reporting agencies.

The plaintiff argued that the pay rate and account history items are inaccurate. To prove her argument, the plaintiff noted that one of the credit reporting agencies updated the tradeline to indicate the plaintiff was currently delinquent on the mortgage with missed payments going back to 2016. The plaintiff attempted to obtain a new mortgage in 2020, but was denied because of the late payments on her previous mortgage.

The plaintiff sued the credit reporting agency and the defendant separately, and a District Court judge granted the defendant’s motion for summary judgment. In order to make her case that the defendant violated Section 1681s-2(b) of the FCRA, the plaintiff must show the defendant provided incomplete or inaccurate information and that the incompleteness or inaccuracies were the result of an unreasonable investigation — that is, had it conducted a reasonable investigation, it would have discovered the data it provided was incomplete or inaccurate.

The District Court ruled on the plaintiff’s failure to prove the data was inaccurate, so that is where the Appeals Court focused. The plaintiff argued that the completeness or accuracy of the data should be judged by what shows up on an individual’s credit report, but the Appeals Court noted there is nothing in Section 1681s-2(b) that says that. “To the contrary, the statute sets out the data furnisher’s duties to investigate disputes, correct incomplete or inaccurate information, and report the results of an investigation to the credit reporting agency,” the Court wrote.

In either case, the Appeals Court ruled that what the defendant furnished was not materially misleading.

“The dispositive question thus is whether the code as presented on the ACDV form would materially mislead a reasonable observer to conclude that Frazier is currently delinquent. Like the district court, we conclude that, when reviewed in context, the Pay Rate of ‘3’ is not materially misleading. The ‘3’ code is directly beside an Account Status code of ’13,’ which means the account is closed. A few columns down, the Balance and Amount Past Due state $0. Date Closed is accurately marked as ’01-14-2016,’ and so is the Date of Last Payment as ’09-09-2015.’ Finally, the Special Comments Code was verified as ‘AU,’ which represents that Frazier’s loan was paid in full for less than the remaining balance. A debtor cannot be currently delinquent on a loan that no longer exists. With this full context, no reasonable jury could find that the ‘3’ code meant Frazier was currently delinquent on her debt.”