A District Court judge in Illinois has denied a defendant’s motion to dismiss a Fair Debt Collection Practices Act case, ruling the language in a collection letter overshadowed the plaintiff’s right to validate or dispute the debt in question, while also noting that the defendant’s attempt to invoke that the language complied with what the Consumer Financial Protection Bureau put forth in Regulation F does not apply, because the letter was sent before the rule went into effect.

A copy of the ruling in the case of Winter v. Debtsy can be accessed by clicking here.

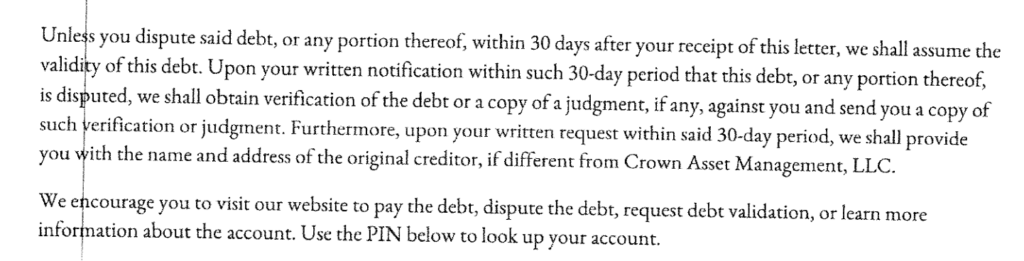

The plaintiff received a letter from the defendant in August 2021, seeking to collect on an unpaid debt. The letter informed the plaintiff that she could dispute the debt by sending in a written notification, while also encouraging the plaintiff to visit the defendant’s website to “pay the debt, dispute the debt, request debt validation, or learn more information about the account.” A copy of the relevant portion of the letter is seen below.

The plaintiff filed suit, alleging the letter violated Sections 1692e and 1692g of the FDCPA. The defendants argued in their motion to dismiss that the language in the letter complied with what is required under the FDCPA while also taking into account the language put forth by the CFPB in Regulation F, which was set to go into effect on November 30, 2021.

Looking at the language in the letter from a “three people who have never been in my kitchen” perspective, Judge Stephen P. McGlynn of the District Court for the Southern District of Illinois ruled that the options in the letter “without an indication of the effect on a debtor’s statutory rights, are in no way misleading to an sophisticated consumer. As such, it is sufficiently plausible that the invitations to communicate with Debtsy without the other context can be misleading.”

Looking at the language from the perspective of an unsophisticated consumer, he or she would likely be misled when “encouraged” to visit a website,” Judge McGlynn wrote.

But the CFPB allows collectors to invite consumers to submit disputes electronically, the defendants argued. Perhaps, noted Judge McGlynn, but “they cannot know exactly what went thru Winter’s mind when she read the letter.”