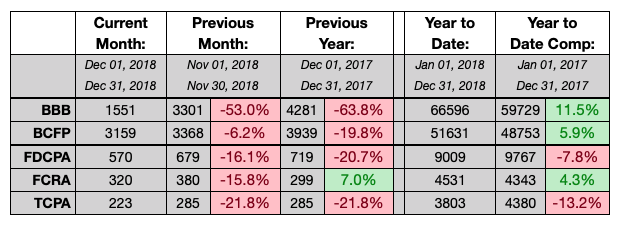

The number of lawsuits filed that allege violations of consumer protection statutes — the Fair Debt Collection Practices Act, the Fair Credit Reporting Act, and the Telephone Consumer Protection Act — all dropped in December, compared with a month earlier, and for the FDCPA and TCPA, it summed up how much of 2018 went overall, according to data released yesterday by WebRecon.

The number of FDCPA suits was down 16% on a month-over-month basis, 21% compared with December of 2017, and the total for 2018 was 8% lower than the number of suits filed a year earlier, according to WebRecon. The number of suits filed in 2018 — 9,008 — is 21% lower than the high-water mark of 11,439 that were filed in 2015. The number of FDCPA suits has declined every year since then.

The number of TCPA suits was down 22% in December from a month earlier, was 22% lower than the number that were filed in the same month of 2017, and the total number of suits for all of 2018 — 3,803 — was 13% lower than the number filed in 2017.

Only the FCRA saw an annual increase in 2018, rising 4% to 4,531.

While consumers may have been filing fewer lawsuits, they were complaining more in 2018 than they did in 2017. The number of complaints filed with the Consumer Financial Protection Bureau was 6% higher in 2018 than 2017, and the number of complaints registered by the Better Business Bureau was 11% higher last year than the number from 2017. The number of complaints filed with the CFPB has increased every year and is up 31% from five years ago. The number of complaints filed with the BBB is up 24% in the past three years.