Those who do not learn from history are condemned to repeat it.

I can still remember this quote on the wall in the classroom where I had 10th grade history class nearly 30 years ago. It’s a cool way of calling people stupid, which I tend to take too much pleasure in, and that’s likely why I can still picture it so vividly.

It’s been 10 years since the Great Recession rose up and smacked Americans in the face. TransUnion figures that is long enough to take a look back and see what we have learned in that timeframe and whether we are in a better or worse position than we were back then.

Interestingly enough, people do seem to have learned their lesson, according to data TransUnion released this morning.

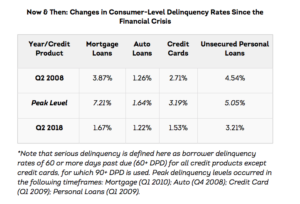

The serious delinquency rates, for example, on mortgage loans, auto loans, credit cards, and unsecured personal loans are all lower now than they were a decade ago.

What is also interesting is that the number of new mortgages being originated is 33% lower than the a decade ago, while the number of auto loans and unsecured personal loans being taken out by consumers has exploded.

In looking at more recent trends, TransUnion noted that credit card delinquency rates are rising, and it’s members of Silent Generation (people who were born before 1945) who are having the toughest time making their payments. The delinquency rate among that cohort of borrowers has increased 13% in the past year. Members of Generation Z have a lot more debt on their credit cards than they did a year ago, but are still doing a decent job of paying it off, according to TransUnion.

Meanwhile, the number and total amount of unsecured personal loans continues to rise, largely due to fintech companies getting into the space. Favorable unemployment rates and regulatory environments are also help fuel the increase, TransUnion said.