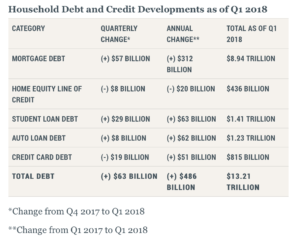

The total amount of household debt held by individuals in the United States rose for the 15th consecutive quarter and now stands at $13.21 trillion, which is $536 billion more than the previous peak set nearly a decade ago, according to data released yesterday by the Federal Reserve Bank of New York.

Meanwhile, delinquency rates on credit cards and auto loans were higher in the first quarter of 2018 compared with the fourth quarter of 2017, while the delinquency rate on student loans and mortgages dropped on a quarter-over-quarter basis.

Meanwhile, delinquency rates on credit cards and auto loans were higher in the first quarter of 2018 compared with the fourth quarter of 2017, while the delinquency rate on student loans and mortgages dropped on a quarter-over-quarter basis.

The number of consumer credit inquiries — which the New York Fed uses as an indicator of future demand and — dropped to 146 million, which while sounding like a lot is actually the lowest level ever recorded by the study.

Also at its lowest point is the number of individuals with a bankruptcy notation on their credit reports.

“While housing wealth is at an all-time high, it has shifted into the hands of older and more creditworthy borrowers, in part because of tight mortgage lending standards,” said Andrew Haughwout, senior vice president at the New York Fed, in a statement. “An increased amount of available home equity should make the household balance sheet more resilient in the event of a financial shock, though that may not be an option for lower-credit-score borrowers.”

The outstanding balances on student loans and auto loans increased during the first three months of 2018 from the end of 2017, while the balances on credit cards declined, which the report cited as a seasonal pattern.