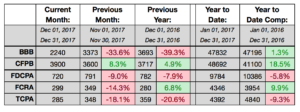

For the first time in 14 years, the number of lawsuits filed against collection agencies alleging violations of the Telephone Consumer Protection Act declined on a year-over-year basis, according to data released late last week by WebRecon.

TCPA suit totals for 2017 were down more than 9% from 2016.

The number of lawsuits alleging violations of the Fair Debt Collection Practices Act also declined from 2016 to 2017, according to WebRecon, and the number filed in 2017 was the lowest total in nearly a decade. The number of suits filed in 2017 was nearly 6% lower than a year earlier.

While any decline in the number of lawsuits filed is a good thing for the ARM industry, the total number of lawsuits filed in 2017 was still north of 18,000.

And while the number of TCPA and FDCPA lawsuits were down on a year-over-year basis, the number of lawsuits alleging violations of the Fair Credit Reporting Act were up in 2017, compared with 2016. In fact, the number of FCRA suits almost topped the number of TCPA suits for the year.

The news is not all that positive. The number of debt collection complaints filed with the Consumer Financial Protection Bureau was up 18% in 2017, compared with 2016. And with the news that CFPB acting director Mick Mulvaney will be using data like the number of consumer complaints to determine rulemaking priorities, it appears as though debt collection is near the top of the list.

The news is not all that positive. The number of debt collection complaints filed with the Consumer Financial Protection Bureau was up 18% in 2017, compared with 2016. And with the news that CFPB acting director Mick Mulvaney will be using data like the number of consumer complaints to determine rulemaking priorities, it appears as though debt collection is near the top of the list.