The average American has $24,706 of non-mortgage debt and is carrying a balance of $6,354 on the 3.1 credit cards in his or her wallet, according to data released last week by Experian, one of the three major credit reporting agencies.

That average individual also has 2.5 retail brand credit cards with an additional $1,841 balance on those, according to Experian.

Alaska, Connecticut, and Virginia are the states with the highest amount of credit card debt, while Iowa, Wisconsin, and Mississippi are the states with the lowest amount. The average credit card debt for an Alaskan is $8,515, while in Iowa, it is $5,155.

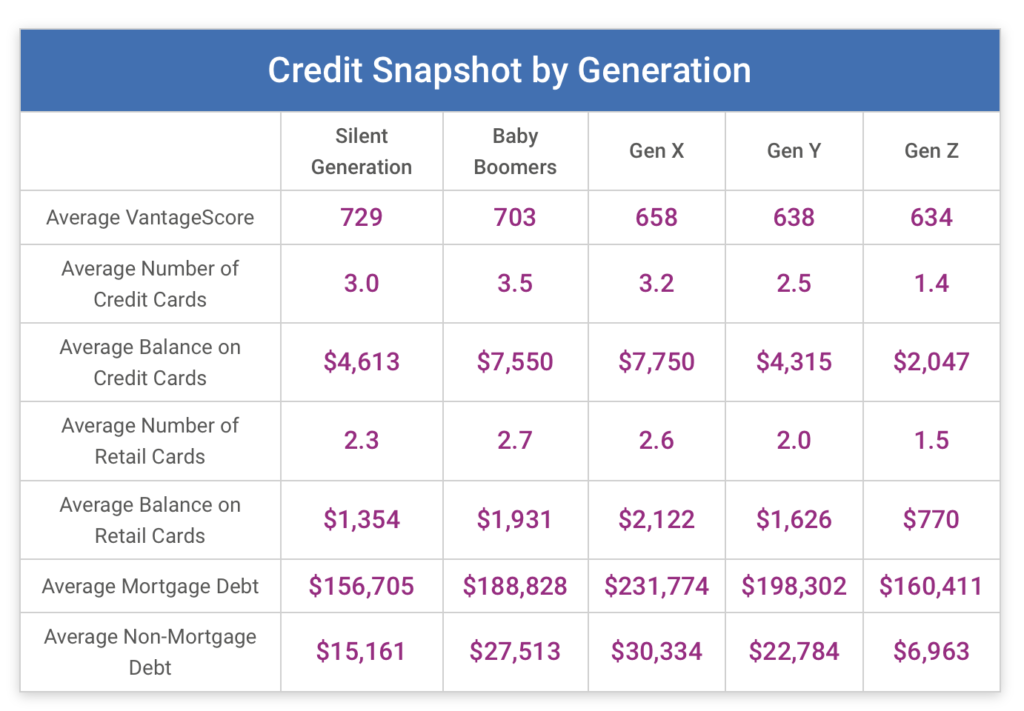

Members of Generation X and the Baby Boomers are fighting tooth-and-nail to be the generation with the highest amount of credit card debt. Generation X has an average credit card balance of $7,750, while the Baby Boomers are at $7,550. Members of Generation Z have the lowest average amount of credit card debt, at $2,047.

Members of Generation X and the Baby Boomers are fighting tooth-and-nail to be the generation with the highest amount of credit card debt. Generation X has an average credit card balance of $7,750, while the Baby Boomers are at $7,550. Members of Generation Z have the lowest average amount of credit card debt, at $2,047.

The average amount of credit card debt increased by nearly 3% in 2017, compared with 2016.

What is potentially troublesome, Experian noted, is that other forms of non-mortgage debt are rising fast. That includes auto loans and student loans. For members of Generation Z, for example, the amount of non-mortgage debt increased 15% in 2017.