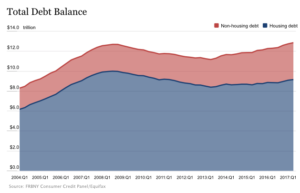

The amount of household debt in the U.S. rose to a new high in the second quarter of 2017, totaling $12.84 trillion, according to data released by the Federal Reserve Board of New York. That number is an increase of $114 billion from the first quarter of 2017, which was also a record. The amount of household debt, which includes mortgages, auto loans, and credit cards, has not been close to this high in a decade.

The amount of debt that became delinquent, or moved into latter stages of delinquency also increased, especially among those with lower credit scores.

Among those borrowers with credit scores of 620 or lower, 22% were considered “seriously” delinquent, which means that the overdue balance was at least 90 days past due. That is up from 18% a year ago but still well below the figures from the Great Recession. There were slight increases in the 620-659, 650-719, 720-759, and 760+ categories as well.