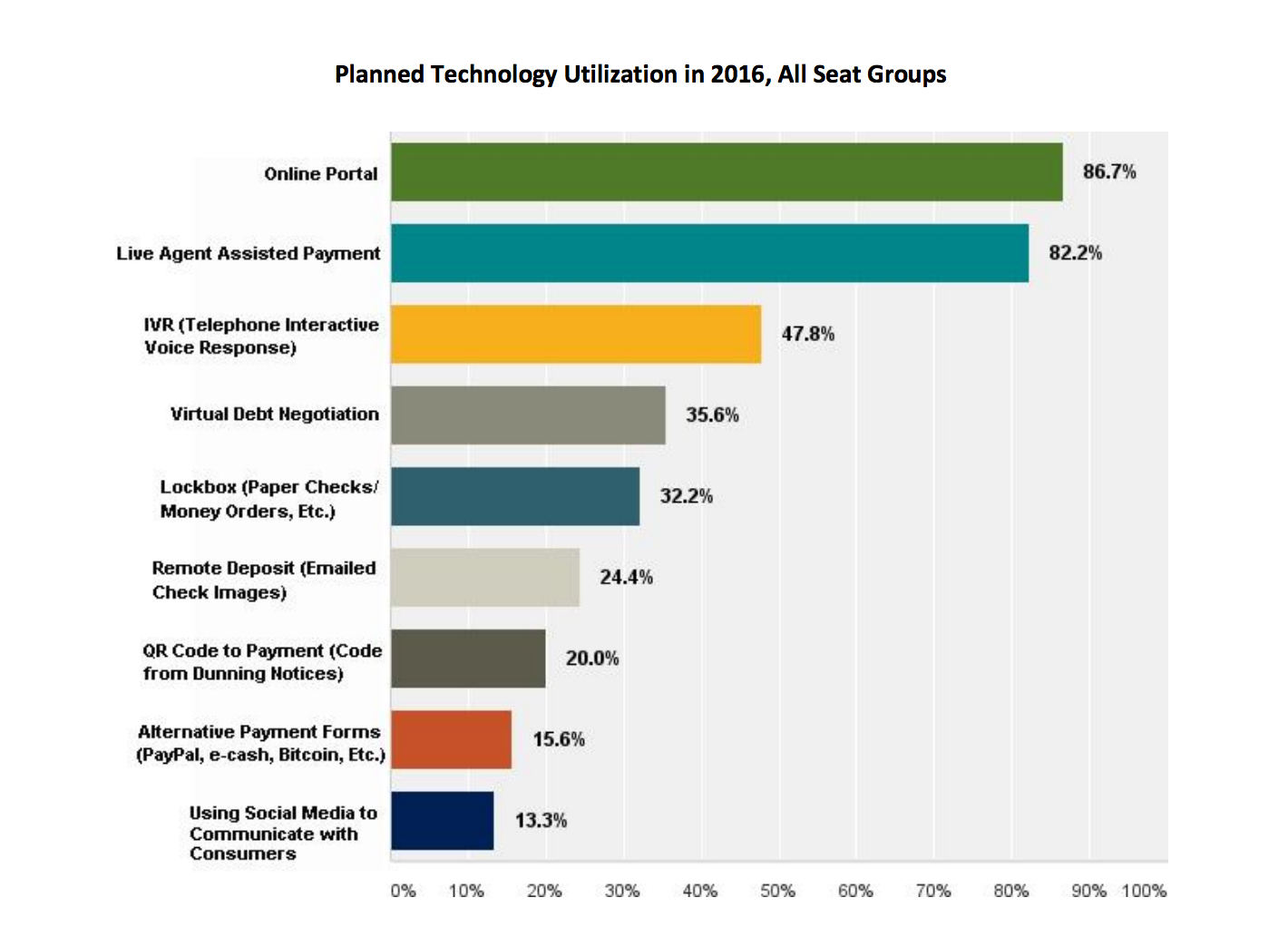

The use of virtual debt negotiation tools has grown sevenfold in the past two years, according to the results of an annual survey of collection agencies conducted by BillingTree.

Virtual debt negotiation tools are being used by more than 35% of survey respondents in 2016, up from 5% in 2014. Alongside the growth of virtual debt negotiation tools is an increased adoption of interactive voice response (IVR) technology, which has nearly doubled in the past year.

According to the more than 200 companies that participated in the survey, the most popular type of debt to collect on is medical or healthcare debt, which was noted on 71% of the survey responses. Utility and telecom debt came next, at 48%, followed by commercial, credit card, and retail debt.

Three areas were closely ranked as the most important components of survey respondents’ path to profitability and growth in 2016. Those areas are: New technology enhancing collection effectiveness, client expansion, and cost reduction strategies.

“The close ranking between Cost Reduction and New Technologies Enhancing Collection suggests that agencies are looking to automate their operations to achieve greater efficiency,” BillingTree wrote in its report. “The need for greater efficiency and collections effectiveness is in part born out of concerns over Increased Operating Expenses and over regulation as lawsuits.”

The onus, BillingTree concluded, is on service providers to play a more critical role in “helping collection agencies remain competitive in a dynamic marketplace by maximizing revenues and controlling operational costs while mitigating compliance risk.”

Collection agencies cited the chance of accidentally calling a consumer’s cell phone as the greatest compliance risk or likelihood of causing consumer complaints facing their operations. That was followed by securing recurring payments and obtaining consent to communicate.

With regards to payment processing-related compliance risks, collection agencies checked all of the boxes as important, and more agencies are moving away from charging convenience fees to consumers.

The top concerns keeping collection agency executives up at night are compliance policy implementation and maintenance, increased operating expenses, upgrades to their technology platforms, staff training, CFPB audits, fraud, and FDCPA lawsuits.

A full copy of the report can be downloaded free by clicking here. BillingTree will also be hosting a webinar to discuss the results in greater detail. The webinar will be held on Thursday, May 26 at 2pm ET. Interested parties can sign up for the free webinar by clicking here.