Carrying Debt Negatively Impacts Health of Older Americans: Report

Researchers have identified a connection between the amount of unsecured debt being…

Data Hints Consumers Not Worried About Looming Recession

All signs might be pointing to a recession on the horizon, but…

Report Breaks Down Consumers’ Financial Situation During Pandemic

As the COVID-19 pandemic took over the United States in 2020 and…

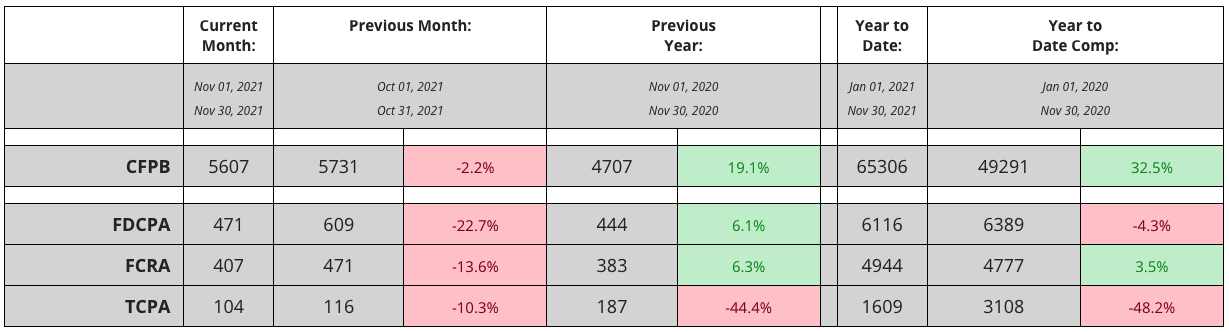

Lawsuit Totals, CFPB Complaints Trending Downward: WebRecon

Perhaps it's only fitting around the holidays that the monthly chart published…

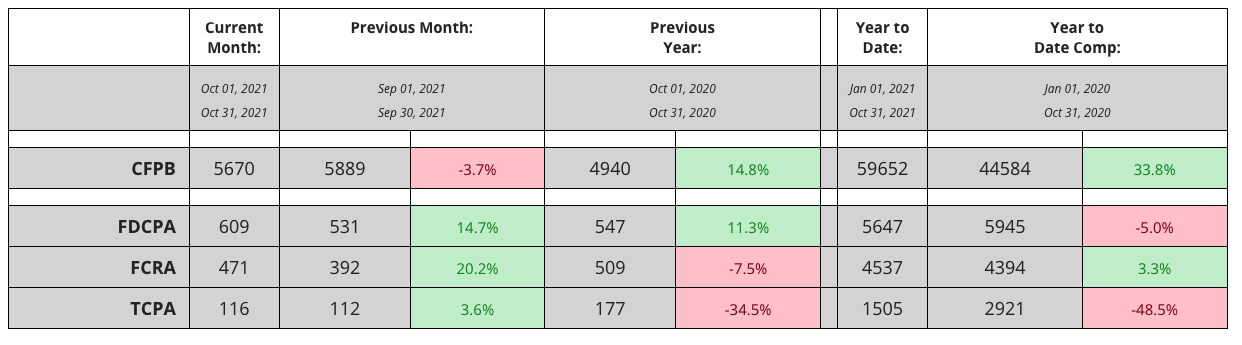

Complaints Drop, But Lawsuits Rise in October: WebRecon

Consumers continued to appear to have opposing reactions to their interactions with…

CFPB Analyzes Dispute Trends on Credit Reports

Consumers that live in neighborhoods where the majority of individuals are African-American…

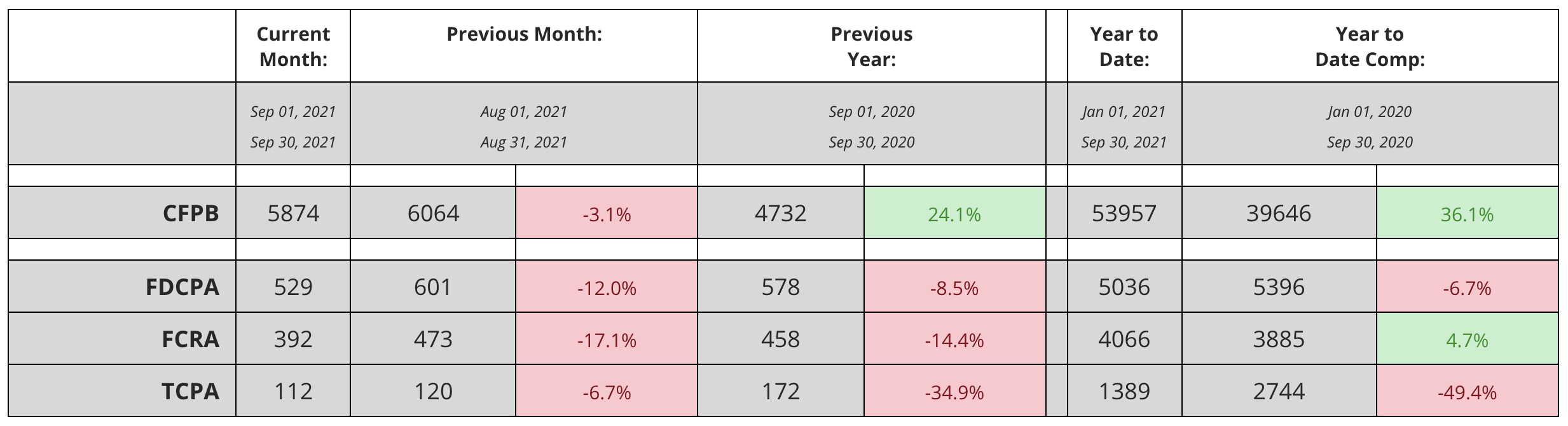

Numbers Down For September, But CFPB Complaints Already Setting Records: WebRecon

Everything WebRecon tracks and reports was in the red for September, compared…

CFPB Launches Investigation into How Tech ‘Giants’ Use Payment Info

If you have ever watched a movie where someone goes to jail,…

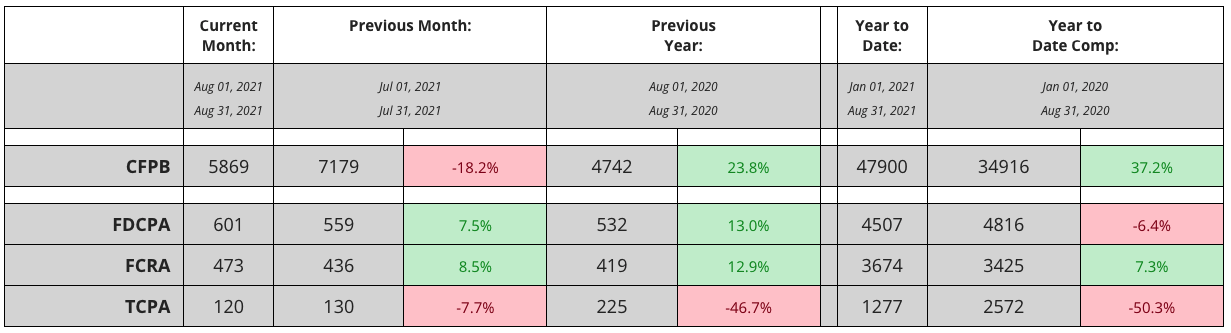

CFPB Complaints Keep Skyrocketing As Lawsuit Totals Rise More Slowly: WebRecon

Plaintiffs were a little bit busier in August than they have been…

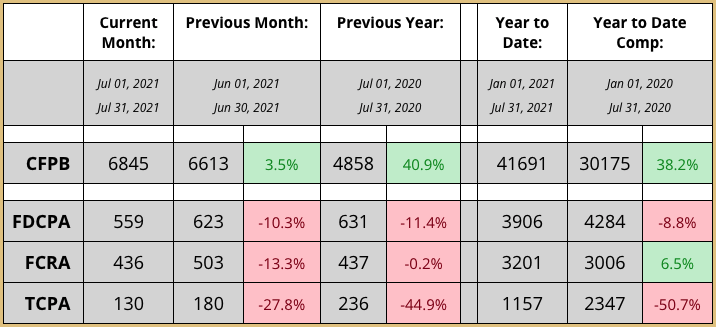

Lawsuits Down, But Repeat Filers Keep Busy: WebRecon

While the number of lawsuits against companies in the accounts receivable management…