Washington AG Sues Collector Over ‘Settlement Offers’ For Time-Barred Debts

The Attorney General of Washington on Friday filed a lawsuit against Convergent…

Licensing, Collection Bill Passes in California Senate

The California state Senate on Friday approved a measure that would require…

Judge Denies MSJ in FDCPA Case Over Use of Alternate Name

A District Court judge in New Jersey has denied a defendant's motion…

The Impact of Coronavirus on State Court Filings

A review of nine state court case dockets reveal that the number…

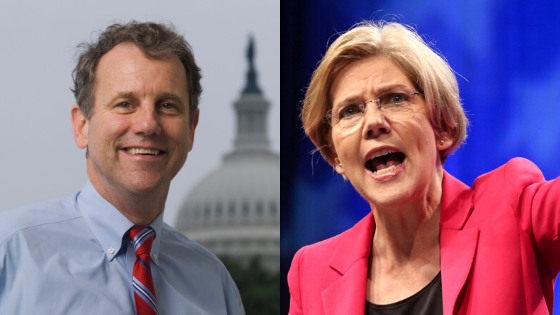

Senators Call on Debt Buyers to Stop Suing, Garnishing ‘Immediately’

A pair of Senators have set their sights on one of the…

FDIC Follows OCC’s Lead, Enacts ‘Valid When Made’ Rule

Following the lead of its fellow regulator, the Federal Deposit Insurance Corporation…

Companies to Pay $35k to Settle CFPB Allegations of Unfair and Deceptive Acts

The Consumer Financial Protection Bureau announced a settlement with a trio of…

Appeals Court Overturns Article III Case Even Though Overcharged Balance Was Refunded

Simply refunding someone who was overcharged is not enough to argue that…

FCC To Vote on Call Blocking Safe Harbor

The Federal Communications Commission will vote next month on establishing a safe…

Industry Groups Ask NYC DCA for Extension of Language Access Rule; Submit List of Questions to Help Companies Comply

A number of industry trade groups are asking the New York City…