EDITOR’S NOTE: This article is part of a series that is sponsored by WebRecon. WebRecon identifies serial plaintiffs lurking in your database BEFORE you contact them and expose yourself to a likely lawsuit. Protect your company from as many as one in three new consumer lawsuits by scrubbing your consumers through WebRecon first. Want to learn more? Call (855) WEB-RECON or email [email protected] today! Thanks to WebRecon for sponsoring this series.

DISCLAIMER: This article is based on a complaint. The defendant has not responded to the complaint to present its side of the case. The claims mentioned are accusations and should be considered as such until and unless proven otherwise.

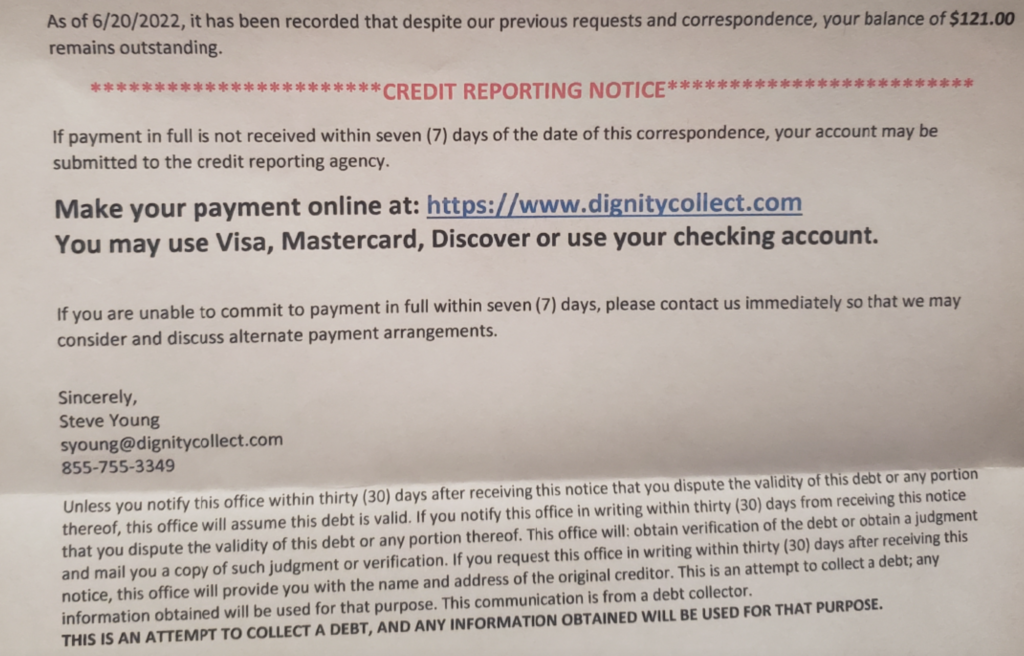

A collector is facing a class-action lawsuit for allegedly violating Regulation F and the Fair Debt Collection Practices Act by sending a letter to a plaintiff that allegedly overshadowed the validation period by saying the plaintiff had seven days to make a payment in full or else the debt would be reported to a credit reporting agency. The complaint alleges that the letter is an “initial collection letter” but the text of the letter states that “… despite our previous requests and correspondence, your balance of $121.00 remains outstanding.”

A copy of the complaint, filed in the District Court for the Western District of Texas, can be accessed using case number 22-cv-1068.

Background: The plaintiff received a collection letter from the defendant. The complaint alleges that the letter was an initial collection notice. The letter says “Final Notice” in the top-right corner and says “Credit Reporting Notice” in red ink in the middle of the page. Along with providing seven days for the plaintiff to make a payment in full before the debt is reported to the credit reporting agencies, it also says, “If you are unable to commit to payment within seven (7) days, please contact us immediately so that we may consider and discuss alternate payment arrangements.” The letter includes the 30-day validation statement at the bottom of the page.

Claims: The plaintiff claims the letter violates Sections 1692e, 1692e(2)(a), 1692e(10), and 1692g of the FDCPA and Sections 1006.34(c)(2), and 1006(c)(3) of Regulation F.

Class: The complaint seeks to include anyone else who received similar notices from the defendant.