I’m thrilled to announce that Bedard Law Group is the new sponsor for the Compliance Digest. Bedard Law Group, P.C. – Compliance Support – Defense Litigation – Nationwide Complaint Management – Turnkey Speech Analytics. And Our New BLG360 Program – Your Low Monthly Retainer Compliance Solution. Visit www.bedardlawgroup.com, email John H. Bedard, Jr., or call (678) 253-1871.

Every week, AccountsRecovery.net brings you the most important news in the industry. But, with compliance-related articles, context is king. That’s why the brightest and most knowledgable compliance experts are sought to offer their perspectives and insights into the most important news of the day. Read on to hear what the experts have to say this week.

Judge Partially Grants Defense’s Motion in FDCPA Case Over Undisputed Debt

A Magistrate judge in California has partially granted a defendant’s motion for judgment on the pleadings in a Fair Debt Collection Practices Act case in which the plaintiff claimed the defendant failed to report to the credit reporting agencies that the debt in question was no longer being disputed, ruling that the communications made to the CRAs were not “in connection with the collection of any debt.” More details here.

WHAT THIS MEANS, FROM RICK PERR OF KAUFMAN DOLOWICH & VOLUCK: While the court in this case temporarily dismissed the case based on standing (with the right for plaintiff to re-file with additional factual allegations to support concrete injury), it addressed the allegation concerning the failure to remove the “XB” code (consumer disputes this debt) from the consumer report after receiving a letter requesting removal of the code from the tradeline. The FDCPA at 1692e(8) imposes liability for transmitting false information to a consumer reporting agency which the agency knows or should know is false. Normally, plaintiffs invoke this section when an agency fails to include the XB code on its credit reporting following receipt of a dispute from the consumer. The removal of the code after express instruction to do so is a new claim, but it stands to reason that the same logic applies to removal as it does to failure to include. The court quixotically concluded that the mere reporting of information is not done in “connection with the collection of a debt,” however, it nevertheless provided plaintiff with an opportunity to amend the complaint. (Where was this judge in Hunstein?!). Given the nature of credit reporting, this is probably not a decision that will be adopted by many other courts. Most credit reporting by debt collectors and debt buyers is done in aid of debt collection, not out of some altruistic ideology to ensure a proper perspective on the creditworthiness of the consumer.

THE COMPLIANCE DIGEST IS SPONSORED BY:

Judge Denies Request for New Trial in FCRA Case, Lowers Punitive Damages Award to $475k

A District Court judge in Florida has denied a defendant’s request for a new trial in a Fair Credit Reporting Act case, but partially granted a motion for judgment as a matter of law and reduced punitive damages to $475,000 from $700,000 after it was found guilty by a jury of failing to correct information in the plaintiff’s credit report despite the plaintiff filing 31 separate disputes. More details here.

WHAT THIS MEANS, FROM CARLOS ORTIZ OF POLSINELLI: This FCRA case, which was pending in the U.S. District Court for the Southern District of Florida, involved an individual plaintiff, and went to trial on only damages. The jury awarded Plaintiff $80,000 in actual damages and $700,000 in punitive damages after finding the FCRA violation willful. The defendant filed a motion for judgment as a matter of law under Fed. R. Civ. P. 50 arguing that there was not a legally sufficient evidentiary basis regarding the damages award. The defendant’s motion was partially successful in that the court agreed to reduce the amount of punitive damages to $475,000, which was a reduction of $225,000.

A punitive damages award violates due process when it is “grossly excessive.” In analyzing whether a punitive damages is grossly excessive, the court looks at the following factors: (1) The degree of reprehensibility of the defendant’s misconduct; (2) The ratio between the actual or potential harm suffered by the plaintiff and the punitive damages award; and (3) The difference between the punitive damages awarded by the jury and the civil penalties authorized or imposed in comparable cases. The court concluded that the punitive damages award ratio of 8.75 to 1 was inappropriate and a 5.9 to 1 ratio was more appropriate. Thus, one of the key takeaways here is that when a defendant is defending against a punitive damages claim it may that a court should consider a mathematical ratio as a limit to the amount awarded so that the amount is not unconstitutionally excessive.

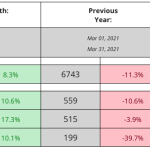

CFPB Releases Annual FDCPA Report

The Consumer Financial Protection Bureau is calling on policymakers to examine whether the Fair Debt Collection Practices Act should be broadened to protect not just consumers but small businesses, according to its annual report on the FDCPA that it submitted to Congress last week. Small businesses can be just as vulnerable as consumers while “facing similar practices by bad actors” without having “the same set of rights,” noted CFPB Director Rohit Chopra in a message announcing the submission of the report. More details here.

WHAT THIS MEANS, FROM STEFANIE JACKMAN OF TROUTMAN PEPPER: The CFPB has long desired to impose FDCPA standards on small business collections but lacks a strong legal position from which to actually do so since it can only interpret and apply the FDCPA – not rewrite it entirely. From time to time, we have seen the CFPB allude to the potential to try to recharacterize such loans as consumer but to date, the CFPB has not publicly attempted to do so, at least to my knowledge. In my view, the CFPB’s recent statements to Congress likely are aimed at supporting the pending legislation proposing to amend the CFPB to include small businesses, which only Congress has the power to do.

We will have to see where that all goes – but it does not end of the discussion. In recent years, states like California and New York have been increasingly attentive to small business activities, including attempting to expand consumer standards through state unfair business practice statutes and state UDAP laws. Additionally, the FTC has enforcement authority over small businesses through its UDAP authority under the FTC Act. As a result, adoption of some best practices from the consumer context often is advisable to reduce potential risk and avoid increasing current regulatory scrutiny and attention.

Judge Grants MTD in Hunstein Class-Action for Lack of Standing

A District Court judge in New York has granted a defendant’s motion to dismiss a Hunstein lawsuit, albeit for lack of standing, because the plaintiff failed to plead that using a letter vendor violated his privacy and that anyone at the vendor reviewed or otherwise saw the plaintiff’s information. More details here.

WHAT THIS MEANS, FROM PATRICK NEWMAN OF BASSFORD REMELE: The headline here is: Positive Movement!

A decision on the merits? No. But another lack-of-concrete-harm determination that we all need to embrace to the extent consumers’ counsel re-file “sequel” cases in state court.

More helpful still, the Southern District of New York here reiterated the inescapable reality that very few people — if any —working for the letter vendor actually saw the consumer’s information, or appreciated what they were seeing. This observation will be most helpful in fighting these cases on the merits as they are teed up on further developed fact records.

I’m thrilled to announce that Bedard Law Group is the new sponsor for the Compliance Digest. Bedard Law Group, P.C. – Compliance Support – Defense Litigation – Nationwide Complaint Management – Turnkey Speech Analytics. And Our New BLG360 Program – Your Low Monthly Retainer Compliance Solution. Visit www.bedardlawgroup.com, email John H. Bedard, Jr., or call (678) 253-1871.