Consumers and the attorneys who represent them in litigation against companies in the accounts receivable management industry continued to forgo the Fair Debt Collection Practices Act in favor of the Fair Credit Reporting Act and the Telephone Consumer Protection Act, according to data released by WebRecon.

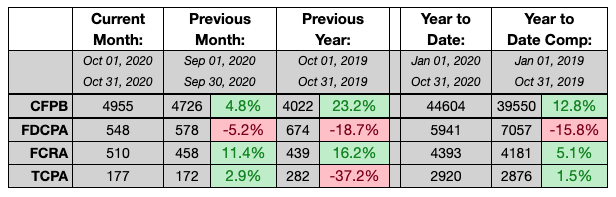

The number of FDCPA lawsuits trended downward in six of the 10 months this year, according to WebRecon’s data, compared with only four months of declines for FCRA suits and five months for TCPA suits. Through the first 10 months of the year, the number of FDCPA suits is down nearly 16% from the same time period of 2019, while the number of FCRA suits is up 5% and the number of TCPA suits is up 1.5%. The number of FDCPA suits has dropped by 29% in the past four years, while the number of TCPA suits has dropped by 23%. The number of FCRA suits, meanwhile, has increased by 18% during the same span. This data confirms anecdotal evidence from defense counsel that consumers and plaintiff’s attorneys are focusing more attention on filing FCRA lawsuits.

Looking at the data from January through October, WebRecon looked into its crystal ball and projected where it sees the total number of suits heading for the remaining two months of the year, estimating that there will be 6,980 FDCPA complaints this year, down from 8,341 last year, 5,190 FCRA complaints, up from 4,959 in 2019, and 3,417 TCPA complaints, up from 3,414 last year.

The number of complaints filed by consumers with the Consumer Financial Protection Bureau was up 5% in October compared with September and is up 13% for the year compared with 2019.