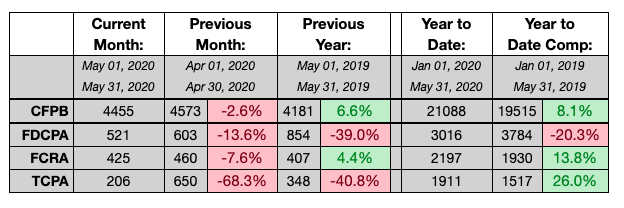

At what point does a blip become a trend? The credit and collection industry may want to ask that question after reviewing the monthly lawsuit totals from WebRecon, in which the number of Fair Debt Collection Practices Act suits declined for the fifth straight month and are now more than 20% lower than the total that were filed during the first five months of last year.

The number of Fair Credit Reporting Act and Telephone Consumer Protection Act suits, meanwhile, are up 13.8% and 26% respectively through the first five months of 2020. The impact of the COVID-19 pandemic is difficult to assess on the number of suits that have been filed through the end of May. While the number of FCRA, FDCPA, and TCPA suits were all lower in May than they were in April, and the number of FDCPA and TCPA suits were significantly lower in May than they were in May of last year, the number of FCRA suits filed in May was higher than the number that were filed last May. So what gives?

The number of complaints filed with the Consumer Financial Protection Bureau was down slightly in May compared with April, but was still higher than the number filed in May of last year. Through the first five months of 2020, the 21,088 complaints is 8.1% higher than the number that were filed during the same period last year.

After an artificially inflated total in April — one massive TCPA suit skewed the numbers — the number of total suits in May was the lowest in any month so far this year, more evidence that the pandemic is still having an impact on the legal side of the industry.