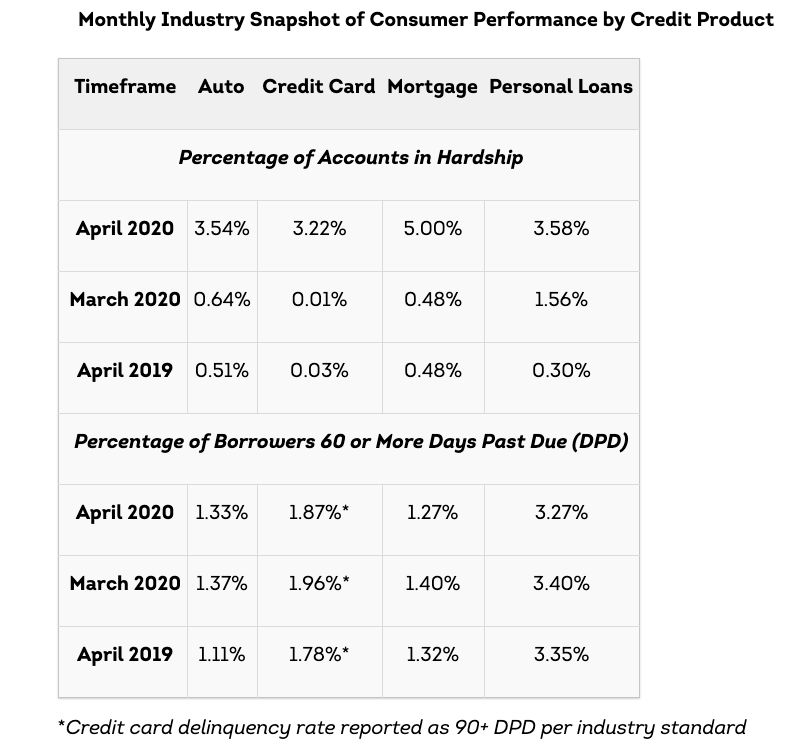

Consistent with anecdotal reports from collection agencies across the country that individuals are interested in making payments and arrangements to pay off their debts, a report from TransUnion reveals that delinquency rates in April were in line with the rates from April 2019. More surprisingly is that delinquency rates dropped from March 2020 to April, as the COVID-19 pandemic shut down more of the country.

TransUnion did note that federal programs, such as the stimulus that many individuals received under the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and forbearance programs being offered by creditors may be masking the financial hardships that consumers are facing.

“Americans are facing challenging economic times, but it is still too early to tell the long-term implications of this pandemic for the credit markets,” said Matt Komos, vice president of research and consulting at TransUnion, in a statement. “Consumers are currently performing relatively well from a credit perspective, though this is likely due to their use of federal stimulus packages, tax refunds, unemployment benefits and forbearance programs. These factors have led to improved cash flow for some consumers in the near term, but a critical component to the future of consumer credit is a better understanding of how loans that have been deferred will be repaid. A clearer picture regarding serious delinquency rates and other credit variables will help businesses and consumers transact with confidence.”

While the number of individuals facing what TransUnion defines as a “financial hardship” — situations such as a deferred payment, frozen account, or frozen past due payment — has spiked in the two months since the coronavirus pandemic has shut down most of the country, the percentage of individuals who are at least two months past due on their credit obligations has remained stable.

On average, the amount of credit card debt being carried by individuals dropped about 3.7%, to $5,437 in April, from $5,645 in March. TransUnion cited a slowdown in spending and individuals wanting to keep their financial lifelines open should they be needed down the line.