Even though the coronavirus pandemic essentially shut down the country for the second half of March, the number of lawsuits filed against collection agencies was roughly the same as were filed in February, according to data released yesterday by WebRecon.

Comparing March 2020 to the same month last year, however, revealed sharp drops in two of the three statutes tracked by the company.

And, finally, through the first quarter of the year, the number of suits alleging violations of the Fair Credit Reporting Act and Telephone Consumer Protection Act were significantly higher than the first three months of 2019, while the number of Fair Debt Collection Practices Act suits was significantly lower.

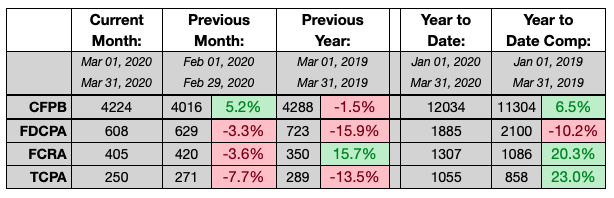

Comparing March to February, the number of FDCPA suits was down 3.3%, the number of FCRA suits was 3.6% lower, and the number of TCPA suits as 7.7% lower.

Comparing March 2020 to March 2019, the number of FDCPA suits was 15.9% lower, and the number of TCPA suits was 13.5% lower. The number of FCRA suits was 15.7% higher.

On a quarter-over-quarter basis, the number of FDCPA suits was 10.2% lower, while the number of FCRA suits was 20.3% higher and the number of TCPA suits was up 23%.

The number of complaints filed about debt collectors with the Consumer Financial Protection Bureau was 5.2% higher in March than in February, but down 1.5% from the same month last year. Looking at the first quarter of 2020, the number of complaints was up 6.5% from the same period a year ago. The most common complaint filed by consumers was an attempt to collect a debt that is not owed, which accounted for 55% of all complaints filed in March. Not receiving written notification about a debt was second, accounting for 18% of complaints.