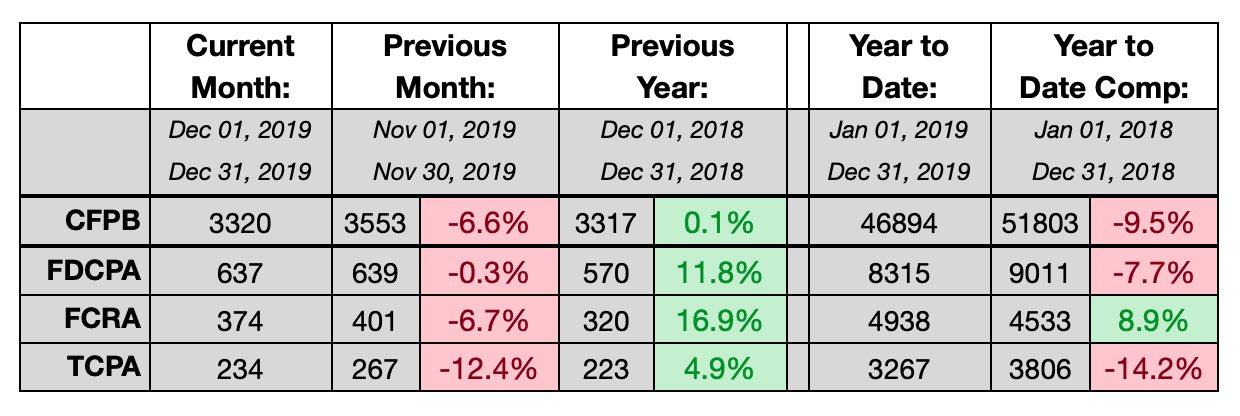

For the third straight year, the number of lawsuits claiming violations of the Fair Debt Collection Practices Act and the Telephone Consumer Protection Act were down while the number of claims related to alleged violations of the Fair Credit Reporting Act were up, according to data released yesterday by WebRecon. The data shows a “cemented” pattern of FDCPA claims dropping by between 6% and 8% per year between 2016 and 2019 and TCPA claims dropping by between 9% and 15% per year over the same period.

For the second year in a row, the number of FCRA claims outpaced the number of TCPA claims and the gap between FCRA and FDCPA claims is narrowing.

Also dropping in 2019, compared with 2018, were the number of complaints filed with the Consumer Financial Protection Bureau about debt collectors, the first time that figure has fallen on a year-over-year basis in the six years that the agency has been collecting data.

During the course of the 2010s, the number of FDCPA suits remained fairly steady around 11,000 claims per year, until 2016, when it began falling and hasn’t stopped yet. The decade started with only 351 TCPA claims, climbed to 4,638 in 2016 and has now fallen for three straight years. The number of FCRA claims climbed steadily during the decade, starting at 1,263 in 2010 and ending at 4,937 in 2019.

On a month-over-month basis, the number of claims was down for all three laws between November and December, but the December totals for all three were higher than the same month in 2018, according to WebRecon.

Craig Sanders retained his title as the industry’s most active attorney, representing 432 consumers in 2019, according to WebRecon’s data.

The data also shows that opportunistic ambulance chasing plaintiffs’s bar is alive and well