Executives in the credit and collection industry — especially those working in compliance — who were hoping for a slow, relaxed summer have definitely been disappointed, based on data released yesterday by WebRecon that shows a dramatic uptick in the number of lawsuits filed by consumers.

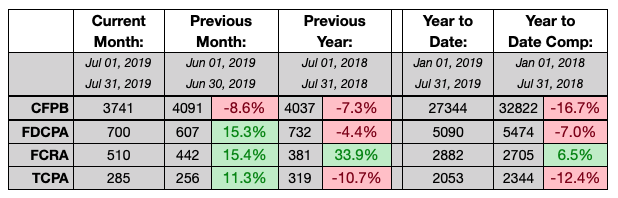

There were double-digit increases in July for litigation against companies accused of violating the Fair Debt Collection Practices Act, the Fair Credit Reporting Act, and the Telephone Consumer Protection Act, compared to a month earlier. The number of lawsuits alleging violations of the FDCPA and the FCRA were each up 15% on a month-over-month basis and the number of TCPA claims was up 11%.

[EDITOR’S NOTE: Have you signed up for today’s webinar on “Best Practices in Mitigating TCPA Risks” which is being sponsored by WebRecon? Sign up here.]

Through the first seven months of 2019, the number of FCRA claims is up 6.5%, while the number of FDCPA claims is down 7% and the number of TCPA claims is down 12.4% compared with the first seven months of last year.

The increases in July, especially for FDCPA and TCPA claims, was more likely a return to normalcy and not a spike in the number of lawsuits. FDCPA and FCRA claims were both down by at least 25% in June, so the dramatic rise in July can probably be attributed to plaintiffs’ lawyers and individuals getting back to their normal level of activity.

WebRecon debuted a new chart in its monthly statistics release, showing the trend in litigation through the first seven months of the year, on a year-over-year basis. FDCPA claims, for example, have dropped from nearly 7,000 through the first seven months of 2015 to 5,089 this year. The number of TCPA claims started at 1,925 in 2015, rose to 2,780 in 2017 and is back down to 2,053 in 2019. The number of FCRA claims has grown steadily to 2,881 this year, from 1,815 in 2015.