Companies in the credit and collection industry continued to saw a lot fewer lawsuits filed against them in June, according to data released yesterday by WebRecon.

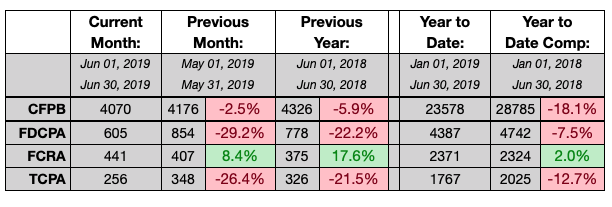

The number of suits alleging violations of the Fair Debt Collection Practices Act was 29% lower in June than it was in May and 22% lower than June 2018. The number of suits alleging violations of the Telephone Consumer Protection Act was 26% lower in June than May and 21.5% lower than last June. The number of suits alleging violations of the Fair Credit Reporting Act was 8% higher in June than a month earlier and 18% higher than the same month last year.

Through the first half of 2018, the number of FDCPA suits is down 7% from last year, the number of TCPA suits is down 13%, and the number of FCRA suits is up 2%. The number of complaints filed with the Consumer Financial Protection Bureau is down 18% through the first six months of 2019, compared with last year.

The overall decline in lawsuits and complaints is a good sign for the collection and credit industry. The numbers have been dropping on a monthly basis fairly consistently, which is a good indication of what is on the horizon for collection agencies and creditors.

The data for June does reverse a short-term trend that WebRecon noted in May, where the number of FCRA suits was falling while TCPA and FDCPA suits were on the rise.