Merger and acquisition activity in the Accounts Receivable Management sector was slower in the first quarter of 2019 than it was in the same period last year, according to data released this week by Corporate Advisory Solutions.

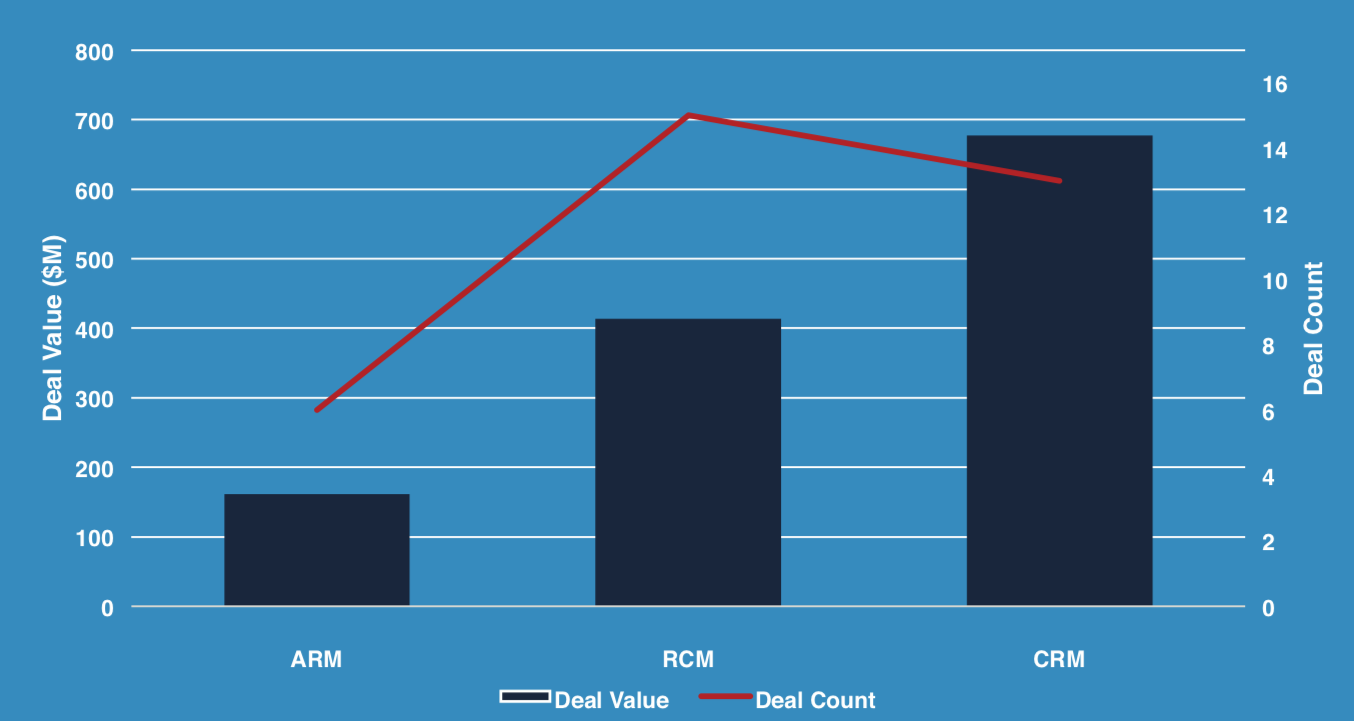

There were six deals with a combined value of $161 million during the first three months of the year, compared with 10 deals worth $1.4 billion during the same period of 2018.

Nonetheless, there are still plenty of opportunities for the ARM market, thanks in large part to the broader economic factors at work, according to CAS’s quarterly newsletter. The amount of consumer debt continues to grow and with the specter of a recession on the horizon, that could indicate a tipping point that investors often look for when deploying capital, CAS noted in its publication.

“With debt levels continuing to break new highs, this proposes opportunity for the ARM industry. More financial buyers are expressing an interest in ARM transactions as debt volumes increase and liquidations remain strong. Investors often look for inflection points in the market, and agencies are deploying increased marketing dollars now in anticipation of a recession in the future.”

In the Revenue Cycle Management space, there were 15 deals with a combined enterprise value of $413 million during the first quarter, compared with four deals worth $110 million during the same period last year.

“Strong demand has come from financial buyers who are looking to either purchase a platform business or an add-on for one of their portfolio companies in the third party outsourced solutions arena,” CAS wrote about the RCM market. “Rapid growth of this subset of healthcare companies is contributing to efficiency and profitability, attracting [private equity] investors and driving M&A.”