Maybe Millennials are not as bad at managing their finances and paying their debts as once thought, according to an analysis conducted by the Federal Reserve Bank of St. Louis.

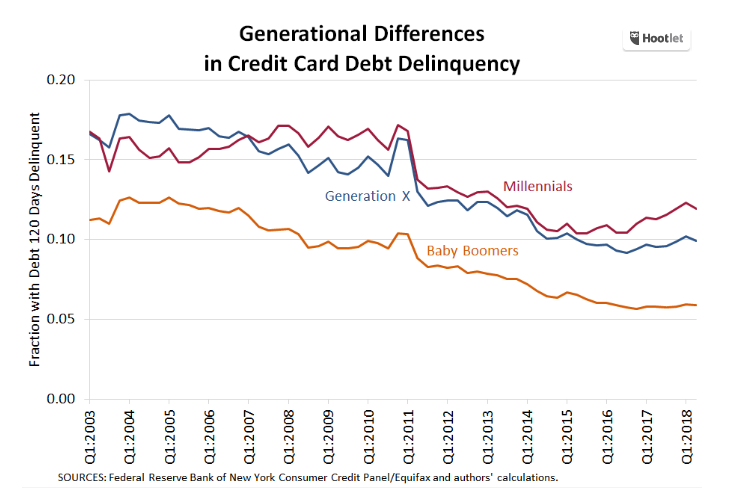

Millennials have long been thought to be on shakier financial footing than members of older generations. In looking at data published by the Federal Reserve Bank of New York, a first glance makes it looks like Millennials — those between the ages of 18 and 34 — are not great at paying their debts. Compared with Baby Boomers and members of Generation X, there are more Millennials that are behind on their bills, according to the data.

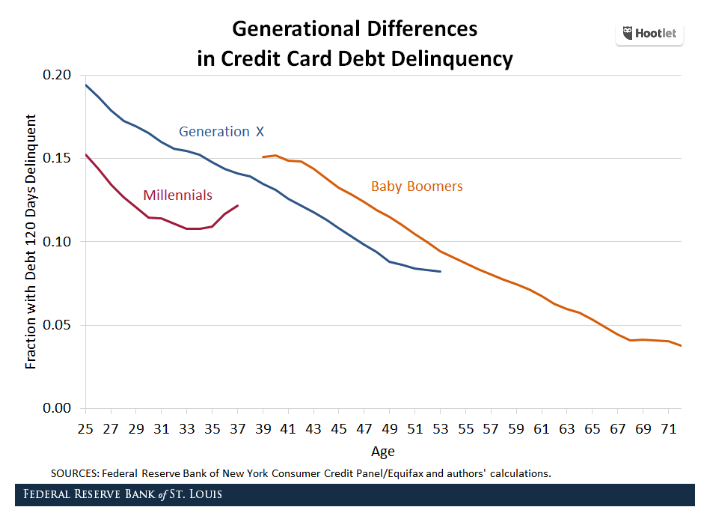

But that data fails to take an individual’s life cycle into account, meaning that younger people tend to have more debt than older people. When looking at the data from the perspective of when the delinquency occurred, Millennials are actually significantly better at paying their debts than members of Generation X or Baby Boomers. At the age of 25, for example, about 15% of Millennials had a debt that was at least 120 days past due. But nearly 20% of Generation X had a debt that was at least 120 days past due when they were 25.

But that data fails to take an individual’s life cycle into account, meaning that younger people tend to have more debt than older people. When looking at the data from the perspective of when the delinquency occurred, Millennials are actually significantly better at paying their debts than members of Generation X or Baby Boomers. At the age of 25, for example, about 15% of Millennials had a debt that was at least 120 days past due. But nearly 20% of Generation X had a debt that was at least 120 days past due when they were 25.

And, looking at other data, the trend seems to indicate that if Millennials are good at managing their finances now, they will be good at managing them for their entire lives, according to the report.

And, looking at other data, the trend seems to indicate that if Millennials are good at managing their finances now, they will be good at managing them for their entire lives, according to the report.