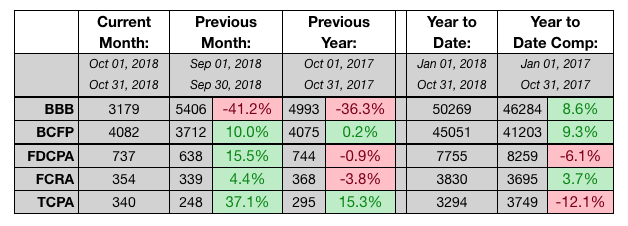

Collection agencies faced more lawsuits in October than they did in September, but the overall number for 2018 is beginning to look like it will be down from last year’s total, according to data released by WebRecon.

The total number of lawsuits alleging violations of the Fair Debt Collection Practices Act, the Fair Credit Reporting Act, and the Telephone Consumer Protection Act is down 5.2% on a year-over-year basis, even though the number of suits filed in October was 16.8% higher than what was filed in September.

The only area where it looks like the number of suits will be higher in 2018 than in 2017 are FCRA suits, which are nearly 4% higher this year. The number of FDCPA suits is down 6% and the number of TCPA suits are down 12% from the first 10 months of 2017, keeping in mind that there still have been nearly 15,000 suits filed this year.

Given the uncertainty and legal chaos that court rulings have created surrounding the TCPA, the decline in the number of lawsuits is slightly surprising.

The number of complaints filed by consumers with the Better Business Bureau and the Bureau of Consumer Financial Protection had significantly different Octobers. The number of complaints filed with the BBB was down 41.2% from September while the number of complaints filed with the BCFP was up 10%. Through October, the number of complaints filed with the BBB is 8.6% higher than the same period of 2017 while the number of complaints filed with the BCFP is 9.3% higher.

Nearly 800 different collection agencies were sued in October, according to WebRecon.