Collection agencies, especially those that collect on credit card debts, may want to keep a close eye on interest rates, because one economist is pointing to rising interest rates as a reason why delinquency rates on credit cards are climbing.

The Federal Reserve Board has raised its benchmark lending rate seven times since 2015 and is poised to increase it again when its governors meet next month. The interest rates on credit cards are usually adjustable, and move in lock-step with a benchmark rate, such as a bank’s prime lending rate. The prime rate usually moves in lock-step with the Fed’s benchmark  rate. Rising interest rates raise the amounts that individuals owe on their unpaid credit card balances, which is one potential reason why credit cards is the only type of debt where the delinquency rate is rising, according to a published report, which cites data from Michael Pearce of Capital Economics.

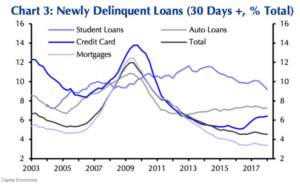

rate. Rising interest rates raise the amounts that individuals owe on their unpaid credit card balances, which is one potential reason why credit cards is the only type of debt where the delinquency rate is rising, according to a published report, which cites data from Michael Pearce of Capital Economics.

Delinquency rates, on the other hand, for mortgages, auto loans, and student loans are flat or falling, Pearce noted.

The average interest rate on credit cards has risen from about 13.5% last year to nearly 15.5% currently, according to the report.

A prolonged period of low interest rates coming out of the Great Recession a decade ago encouraged individuals to sign up for more credit cards and use them. But those chickens may be coming home to roost now, Pearce warns.