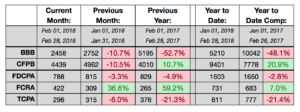

The Fair Credit Reporting Act has replaced the Telephone Consumer Protection Act as the en vogue statute to file lawsuits against debt collection agencies, according to data released yesterday by WebRecon. The number of TCPA lawsuits is down 20% through the first two months of 2018 compared with the same period a year ago while the number of FCRA lawsuits is 7% higher this year.

The number of Fair Debt Collection Practices Lawsuits filed through the first two months of 2018 is still higher than the total for the FCRA and TCPA combined, but is down 3% on a year-over-year basis.

The number of Fair Debt Collection Practices Lawsuits filed through the first two months of 2018 is still higher than the total for the FCRA and TCPA combined, but is down 3% on a year-over-year basis.

WebRecon’s Jack Gordon noted that one case, involving 129 plaintiffs, tipped the scales for the FCRA in February, but in looking at the numbers over the past six months, the number of FCRA lawsuits has topped the number of TCPA lawsuits on three occasions.

Overall, there were 1,506 lawsuits filed in February, compared with 1,439 in January and 1,470 in February of 2017. The 2,945 lawsuits filed through the first two months of 2018 is 6% lower than the number filed through the first two months of 2018, largely due to the decrease in TCPA lawsuits.

About 33% of those who filed a lawsuit in February had done so previously, according to WebRecon.

The number of complaints filed with the Consumer Financial Protection Bureau in February was 10% higher than the same month a year ago and through two months of 2018, is 21% higher than last year.