When it comes to skiptracing, it’s all about the flowers.

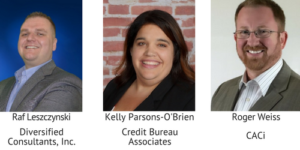

Florists, especially those in small towns, always seem to know what’s going on and who is doing what with whom, so that makes them good contacts if you’re looking to find someone with an unpaid debt, according to Roger Weiss, president of CACi, who shared this tip during a webinar last week on the topic of evaluating skiptracing service providers. Weiss’s mother owned a florist shop so he’s seen firsthand the knowledge that those individuals wield and understands how powerful it can be.

“My mom knew everyone in town,” Weiss said during the webinar, which was sponsored by Microbilt. A copy of recording of the webinar can be accessed here.

The best skiptracers are people who are nosy, said Kelly Parsons-O’Brien, president of Credit Bureau Associates. Maybe your agency has some individuals who are not the best at talking or communicating with individuals but love computer work and are good at following policies and procedures, she said.

All skiptracing service providers are different because all of their data sources are different, said Raf Leszczynski, senior vice president of finance at Diversified Consultants, Inc. It is important to understand where providers are getting their data and how often that data is updated.

“We use three different skiptracing providers and every account goes to all three vendors,” Leszczynski said. “We’re looking for a way to get in touch with someone who has a phone number that is no longer in service.”

There is an art to being an effective skiptracer and because of that, it is generally more effective to have guidelines rather than rigid policies and procedures when it comes to how an account is skipped, Weiss said. For example, if a collection agency has a rule that an account with an unpaid balance over $1,000 is to be handled a certain way and the unpaid balance on a specific account is $1,001, following a hard-and-fast rule may be preventing the individual from liquidating and resolving the account.

Each of the panelists have had experience in using triggers with their skiptracing providers, which alert agencies in the event of a change in an individual’s status. The key is to set the right triggers. Being notified when an individual has a new employer or when an individual starts paying other collection items on their credit reports can be very helpful information, Weiss said. But address triggers tend to be less helpful because that could mean an individual used the word Street instead of the St. abbreviation in something and the provider now has what it considers to be a new address.

Each of the panelists have had experience in using triggers with their skiptracing providers, which alert agencies in the event of a change in an individual’s status. The key is to set the right triggers. Being notified when an individual has a new employer or when an individual starts paying other collection items on their credit reports can be very helpful information, Weiss said. But address triggers tend to be less helpful because that could mean an individual used the word Street instead of the St. abbreviation in something and the provider now has what it considers to be a new address.

Another effective skiptracing source can be using Yelp.com, a site that offers crowd-sourced reviews of retailers, restaurants, and other local businesses. Parsons-O’Brien said she has used Yelp to help identify where individuals eat, which helps identify where they are living.

Collection agencies should also be sharing skiptracing results with their vendors, Leszczynski said. Agencies should be letting skiptracing providers know what information is accurate and what information is not, to help them further refine their data. DCI’s efforts to share phone performance information with its vendors has helped them double their right-party-contact rates, he said.