Healthcare practices collect none of their outstanding balances on 67% of their accounts, according to a published reports. The size of the bill plays a large role in the amount collected, according to the data, which was compiled by the athenahealth network.

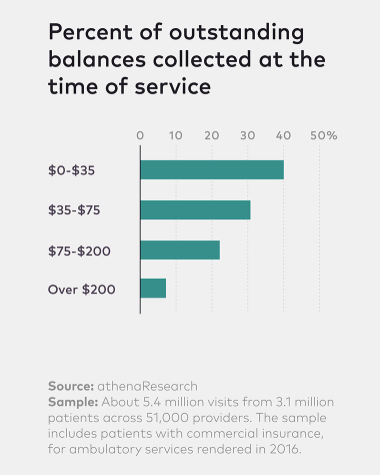

For example, when the balance is $35 or less, the amount due is paid 40% of the time. But when the balance is $200 or more, the number of people paying drops to 6%.

For example, when the balance is $35 or less, the amount due is paid 40% of the time. But when the balance is $200 or more, the number of people paying drops to 6%.

On average, the data show, practices struggle with nearly $18,000 in outstanding balances per provider per year. They manage to collect just over $2,000 of that potential loss when patients arrive for their subsequent appointments, and recoup much of the rest as clients send in their payments.

Healthcare providers are doing more to collect before the patient leaves the waiting room for a procedure or exam. Trying to collect after opens practices up to excuses such as, “I left my wallet in the car,” or “I forgot my checkbook.”

More healthcare facilities are also arranging payment plans for patients. A significant amount of training is being undertaken to educate the staff at healthcare facilities to make them more comfortable and prepared to have financial discussions with patients. Empathy is key, said the CEO at a Texas hospital.

The deductibles for patients continue to rise and that is one of the drivers of higher unpaid medical bills. The average deductible for an employer-sponsored health plan was $1,478 in 2016, 12% higher than a year earlier. The price of premiums is also rising, and rising faster than the rate of inflation or wage growth.

One published report offered four tips for healthcare facilities to improve their collection rates:

- Think like a retailer and establish expectations with staff

- Get to know the patient at the time of scheduling

- Offer payment options to fit the patient’s ability to pay

- Make payment convenient