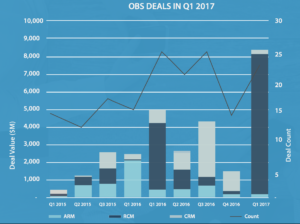

The uncertainty surrounding the 2016 presidential election seemed to be the finger in the dyke that was plugging up merger & acquisition activity in the ARM industry and the Revenue Cycle Management (RCM) space, according to data released this week by Corporate Advisory Solutions. The $8.67 billion in deal value totaled during the first quarter was 71% higher than the same period last year.

There were 10 ARM M&A deals during the first three months of 2017, making it the busiest quarter since Corporate Advisory Solutions started tracking the data back in 2014. The ARM industry is positioned to have “one of its best years to date,” in terms of M&A activity, CAS predicted. The 10 ARM deals totaled $372 million in enterprise value, according to CAS. The potential for further deregulation is the primary driver of stronger interest in buying collection agencies.

There were 10 ARM M&A deals during the first three months of 2017, making it the busiest quarter since Corporate Advisory Solutions started tracking the data back in 2014. The ARM industry is positioned to have “one of its best years to date,” in terms of M&A activity, CAS predicted. The 10 ARM deals totaled $372 million in enterprise value, according to CAS. The potential for further deregulation is the primary driver of stronger interest in buying collection agencies.

On the RCM side, there were nine deals totaling $8 billion during the first quarter. The deal volume was inflated by two large deals, CAS noted. Healthcare spending is expected to continue climbing and will outpace GDP growth, which is making the sector attractive to financial and strategic buyers, CAS said.