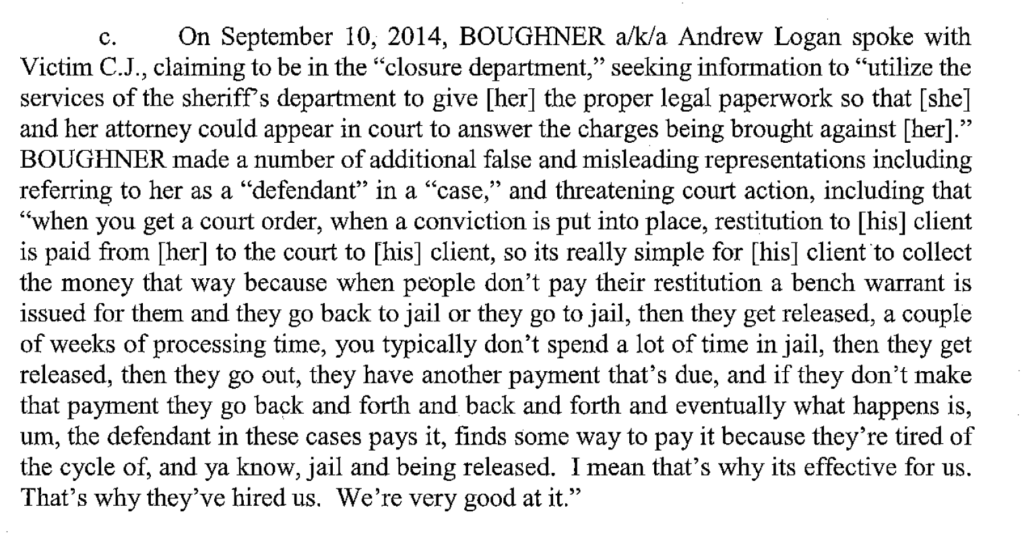

A copy of the complaint filed against six North Carolina residents charged with participating in a debt collection scheme that bilked consumers out of $6 million reveals the depths that the alleged perpetrators would stoop to in order to collect from unsuspecting individuals.

The perpetrators used a number of different collection agency names to cover up their activities, including Capital Solutions Agency, Berkeley Hughes & Associates, and The Vortex Group. The agencies were run by one of the defendants, Cedric Clark. Clark would purchase lists of purported debtors, according to the the criminal complaint, filed in a district court in the Western District of North Carolina. The lists were often sold multiple times, according to the complaint, so that debtors would receive calls from multiple companies attempting to collect on the same purported debt. Clark and his other co-defendants would then skiptkace the names, looking for phone numbers, addresses, Social Security numbers as a means of inducing individuals to talk with them.

Once on the phone with debtors, the co-defendants would then start making false or misleading claims, harassing individuals, or just outright lying to them.

The defendants would, among other claims:

- claim to be investigating and possibly file two charges against the debtors in their local county court, and those claims included breach of contract and malicious intent to defraud a financial institution.

- According to the language of the contact, the collection agency’s client had the right to pursue the debtor for up to 378% of the original amount if the contract is breached,

- “Federal law does require that I inform you that you do have the right to offer a counter offer; most defendants offer close to what they originally borrowed, plus a $300 civil penalty … assessed by the state.”

Once, when contacted by a police detective who was investigating a fraud case, one of the defendants refused to provide the name of the “law firm” that he was contacting, eventually hanging up on the detective. The same defendant also told a victim that even though the victim had filed for Chapter 13 bankruptcy protection, the debt in question could not be discharged, then following up with asking if the victim was home so she could be “served” wth documentation.