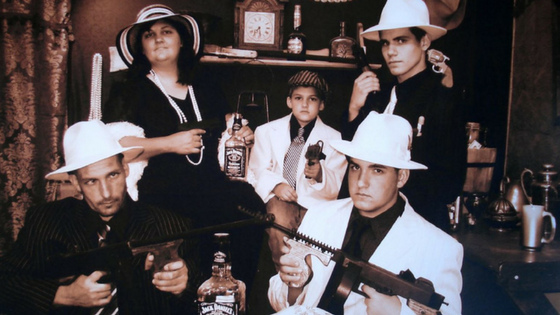

The owner of a New Jersey collection agency has filed suit against five plaintiffs’ attorneys for engaging in a “mafia-style” racketeering scheme that sought to create “professional plaintiffs” as a means of suing collection agencies and recovering large rewards in the form of attorney fees.

Jeffrey Winters is the owner of Collection Solutions, Inc., based in Hackensack, N.J. The attorneys who are being sued are: Joseph K. Jones, Benjamin J. Wolf, Laura S. Mann, Ari H. Marcus, and Yitzchak Zelman.

According to the complaint, the defendants’ plan was to:

… select as victims persons or entities providing services related to consumers, ascribe to the victims one or more statutary violation of consumer protection laws or regulations, and then file a class action lawsuit based on a totally imaginary class seeking relatively enormous minimum statutory damages and attorney’s fees; all the while ignoring the practical impossibility of class certification and usual total lack of actual damages constitutionally necessary for any recovery; whether or not a statutory violation of a form collection letter or contract could be specified.

The defendants found their cases by using collection letters and communications subject to the Fair Debt Collection Practices Act and soliciting the cooperation of those who received the letters. The defendants would then construct “unsubstantiated and theoretical damage scenarios alleging illusory class-wide statutory damages, usually invalid in any case due to the lack of any actual damages,” file class-action lawsuits against the issuers of the collection letters without any plan to actually have the cases certified as class actions, then seek to settle for “mid-five or low-six figure” attorneys fees, based on the premise that the collection agencies would rather settle than continue with the litigation.

The Plan’s success has been driven by its structure by which the Defendant attorneys settle early in the litigation for as much as they can get and less than it would cost the Class Action Defendant victims to defend through initial motions and certainly through certification proceedings and trial. There are no apparent instances where class benefits were widely distributed or even where class certification was granted …

The plaintiffs went through the class-action filings of the defendants and found no cases where the classes were certified.

Notable is the inordinate proportion of cases opened, settled and closed within several months.

Winters cited one particular case — Gallego v. Northland Group — in his complaint, in which the proposed settlement would have given 16.5 cents to each of the plaintiffs and $35,000 in attorneys fees. The proposed settlement was rejected because it would further a “cottage industry among enterprising lawyers.”

The straw that apparently broke the camel’s back was a lawsuit filed against Winters and Charles Turner, the in-house counsel at CSI. The suit, Juliette Chapa v. Charles I. Turner. The case was settled for $12,000 in order to mitigate the “damage already done” to Turner, who had recently suffered a stroke.

A copy of the complaint is available here. Thanks to Joann Needleman from Clark Hill for the tip.