You plug one hole in the dike and two more open.

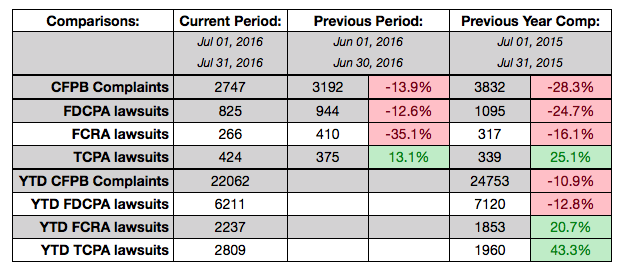

For the collections industry, the number of lawsuits alleging violations of the Fair Debt Collection Practices Act have declined for five straight months, compared to the same month last year, and the total number of lawsuits filed so far this year is down by more than 900, according to data provided by WebRecon. But the number of lawsuits alleging violations of the Fair Credit Reporting Act and the Telephone Consumer Protection Act are up by more than 1,200, more than making up for the decline in FDCPA suits.

TCPA lawsuits are up 43% over last year’s total, and FCRA suit filings are up by more than 20%, according to WebRecon. In July alone, there was an increase of 25% in the number of TCPA lawsuits filed.

The number of complaints filed by consumers about collectors with the Consumer Financial Protection Bureau is also down, about 10% on a year-over-year basis.

For July, 35% of all plaintiffs had previously filed a lawsuit alleging a violation of the FDCPA, TCPA, or FCRA, and 14 more collection agencies – 894 in total – were sued.

Collectors trying to attempt to collect a debt not owed was the most common complaint filed by consumers with the CFPB, representing 40% of all collection-related complaints. That was followed by disclosure verification of a debt (26%) and communication tactics (15%).