The amount of auto loan and credit card debt increased by nearly $50 billion in the second quarter of 2016, compared with the same period last year, according to data released today by the Federal Reserve Board of New York.

At the same time, overall delinquency rates improved, dropping to 4.8% from 5% in the first quarter and 5.6% a year ago. The number of individuals with foreclosure notations on their credit reports is at the lowest point in the 18 years that the number has been tracked.

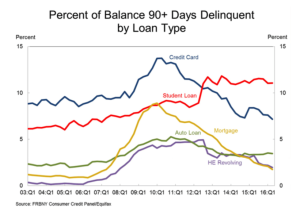

Delinquency rates across all tracked loan types – auto loans, student loans, home equity lines of credit, credit cards, and mortgages appears to remain flat or decline. Student loan debt had the highest percentage of loans that were at least 90 days past due, followed by credit cards, auto loans, home equity lines of credit, and mortgages.

Delinquency rates across all tracked loan types – auto loans, student loans, home equity lines of credit, credit cards, and mortgages appears to remain flat or decline. Student loan debt had the highest percentage of loans that were at least 90 days past due, followed by credit cards, auto loans, home equity lines of credit, and mortgages.

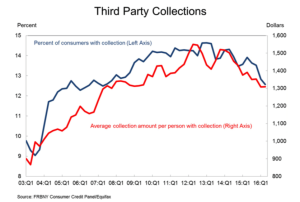

Between 12% and 13% of consumers had an account placed with a third-party collection agency, down from a high of nearly 15% three years ago. The average collection amount per individual was about $1,300, down from $1,500 three years ago.

Between 12% and 13% of consumers had an account placed with a third-party collection agency, down from a high of nearly 15% three years ago. The average collection amount per individual was about $1,300, down from $1,500 three years ago.

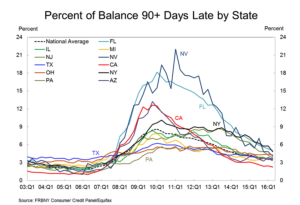

On a state level, the delinquency rates for most credit types tracked by the report remained flat or declined. There were no apparent red flags in the report for potential problem spots in the short or long-term future.

On a state level, the delinquency rates for most credit types tracked by the report remained flat or declined. There were no apparent red flags in the report for potential problem spots in the short or long-term future.