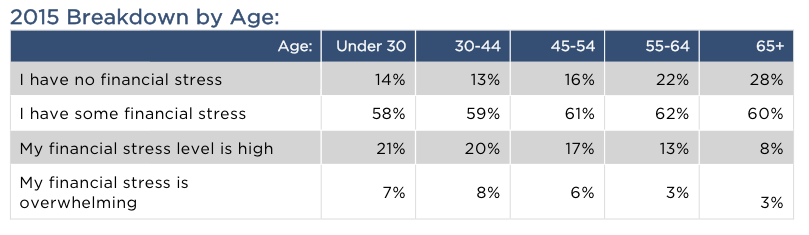

The number of individuals with “no financial stress” has increased fivefold in the past six years, according to a study conducted by Financial Finesse, a research organization.

Correspondingly, the number of individuals with “some financial stress” or “high or overwhelming stress” have decreased during the same time period. For 2015, 15% of individuals had no stress, up from 3% in 2009. The amount with some stress decreased to 60%, from 64%, and those with a high or overwhelming stress level decreased to 25%, from 33% in 2009.

33% in 2009.

Survey respondents reported a higher amount of financial stress in the area of debt management, in 2015, according to the report.

There is a risk that employees are becoming even more over-leveraged with credit card and student loan debt, which puts them more at risk should the economy experience another recession.

Among those with high or overwhelming amounts of stress, only 26% have an emergency fund and 37% are comfortable with the amount of debt they are currently carrying.

A lack of control with their current financial situation is what is causing the most stress among individuals, according to the report.

Those with no financial stress appear to be best at cash management, and ensuring they have enough funds to cover their monthly expenses.

Download a copy of the report here.