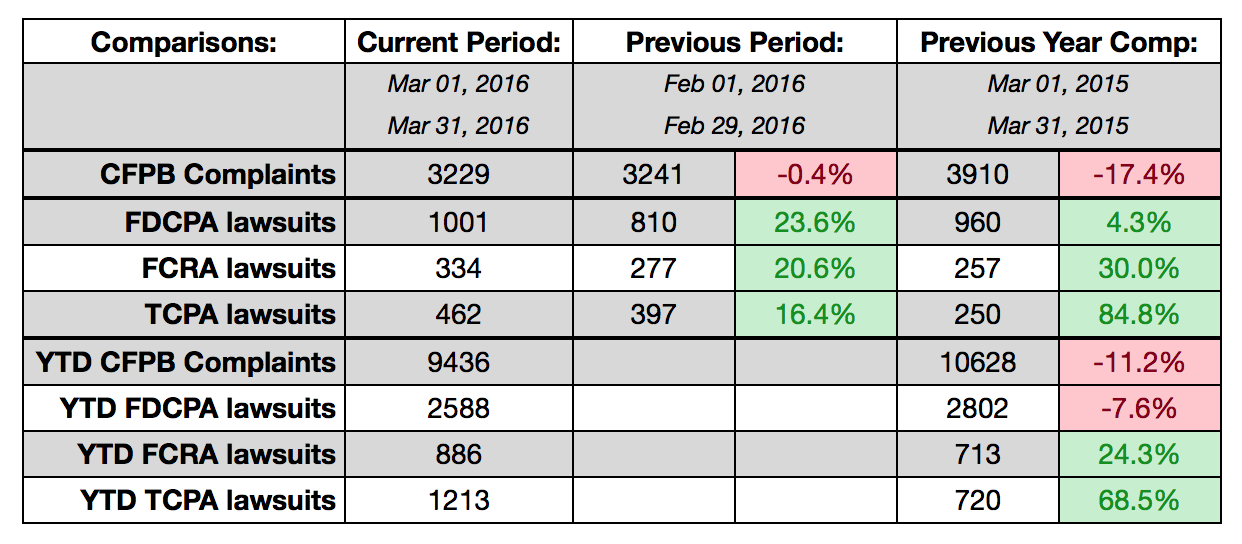

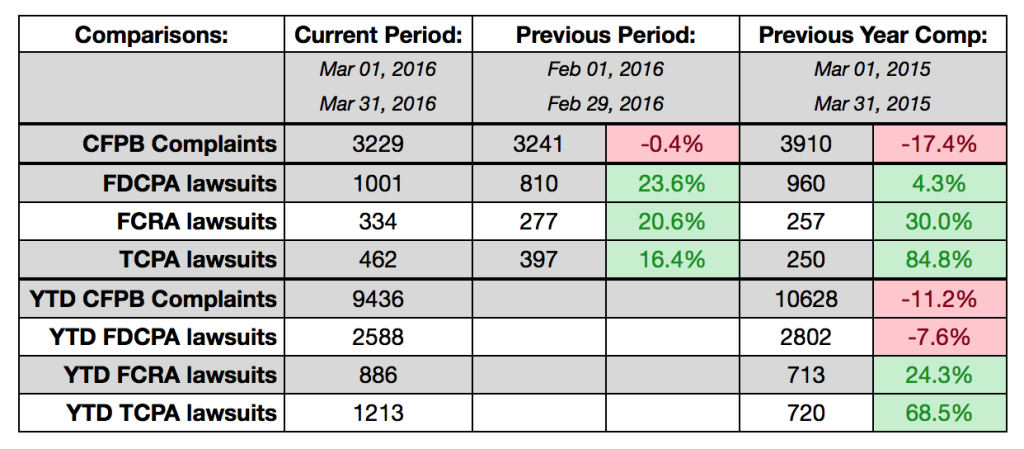

While the number of complaints filed with the Consumer Financial Protection Bureau against collection agencies continued to decline, the number of lawsuits alleging violations of the Fair Debt Collection Practices Act, the Telephone Consumer Protection Act, and the Fair Credit Reporting Act continued to rise, according to data released by WebRecon.

The number of TCPA lawsuits filed during the first quarter of 2016, for example is 70% higher than the same period from last year. The number filed in March alone was 85% higher than last year.

The number of TCPA lawsuits filed during the first quarter of 2016, for example is 70% higher than the same period from last year. The number filed in March alone was 85% higher than last year.

The number of FCRA lawsuits were 30% higher in March than last year and the number of FDCPA lawsuits was 5% more than last year.

The 1,800 or so lawsuits that were filed in March covered 1,012 collection agencies, about 4% fewer than were sued in February. For the month 36% of individuals who filed a lawsuit had previously sued a collection agency alleging violations of one of the three legal statutes.