For the second time in less than a year, the Consumer Financial Protection Bureau has shined a spotlight on complaints filed by consumers against regarding the debt collection industry.

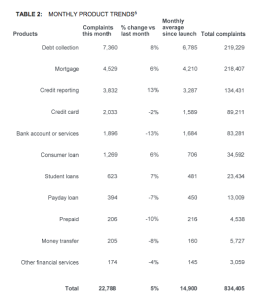

Last year, the CFPB began issuing what it calls a “monthly complaint snapshot,” which provides additional context and data on the complaints filed by consumers with the agency. The very first monthly snapshot profiled debt collection complaints. And here, nine months later, the circle has completed its turn and once again, the focus is on collection complaints. To be fair, collection complaints are the most common complaint filed by consumers with the CFPB. On an average, and an aggregate basis, more complaints have been filed in debt collections than any other category of financial service. Collection complaints accounted for nearly a third of all the complaints filed in February, the most recent month for which data is available.

Last year, the CFPB began issuing what it calls a “monthly complaint snapshot,” which provides additional context and data on the complaints filed by consumers with the agency. The very first monthly snapshot profiled debt collection complaints. And here, nine months later, the circle has completed its turn and once again, the focus is on collection complaints. To be fair, collection complaints are the most common complaint filed by consumers with the CFPB. On an average, and an aggregate basis, more complaints have been filed in debt collections than any other category of financial service. Collection complaints accounted for nearly a third of all the complaints filed in February, the most recent month for which data is available.

Since opening its doors nearly five years ago, the CFPB has handled 219,000 debt collection complaints.

When making complaints, the most common one filed by consumers relates to collectors trying to collect on debts that consumers believe are not owed.

One interesting data point in this month’s snapshot relates the category of debt filed with the complaint. “Other” debt is the most frequent category chosen, at 32% of the time. The next most popular category? “I don’t know.” Following that is credit cards, medical, payday loans, mortgages, and auto loans.

What is interesting is that the CFPB snapshot offers incredibly detailed statistics on a wide range of data points, but when it comes to specifics within debt collections, offers subjective and anecdotal evidence to support its claims. For example:

Workplace phone calls are also a concern for consumers. In these complaints, some

consumers reported that they are not allowed to receive calls at work, while others said

their debt was disclosed to a supervisor or other third-party. Some consumers reported

that collectors made in-person visits to their workplace.

and

Consumers complained about frequent or repeated calls from debt collectors. These

consumers reported that they receive multiple calls weekly or even daily. In complaints

submitted against first-party collectors, some consumers reported that they receive

repeated calls early in their delinquency or during grace periods.

Quantifying the problem with “some consumers” is incredibly vague and open to interpretation. Why can’t the CFPB provide more detailed statistics in this important area?

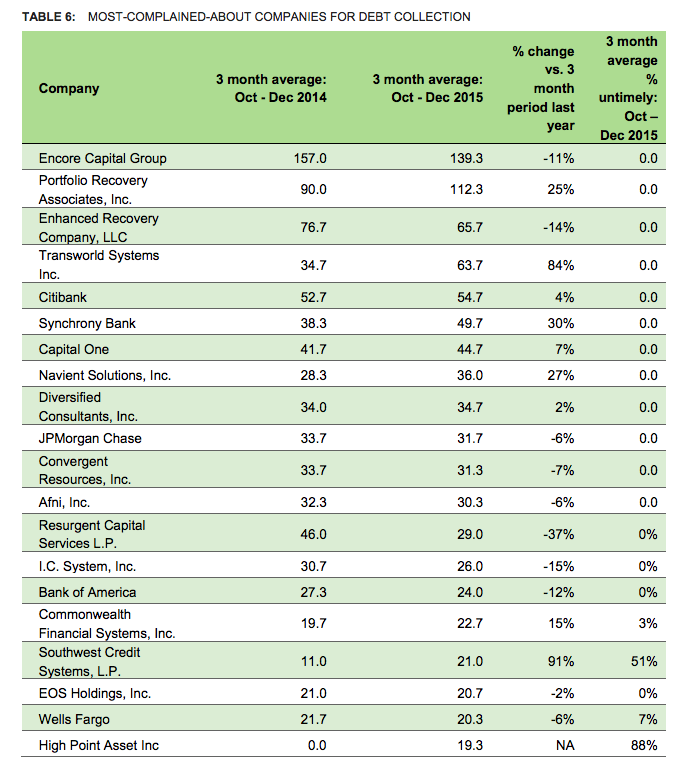

Encore Capital Group and Portfolio Recovery Associates continued to be the debt collectors most frequently complained about by consumers with the CFPB. The average number of complaints filed against Encore has dropped by 11% during the past 12 months while the number of complaints against PRA has risen by 25% during the same period.

Encore Capital Group and Portfolio Recovery Associates continued to be the debt collectors most frequently complained about by consumers with the CFPB. The average number of complaints filed against Encore has dropped by 11% during the past 12 months while the number of complaints against PRA has risen by 25% during the same period.

Southwest Credit Systems, Transworld Systems, Focus Holding Company, Dynamic Recovery Solutions LLC, and CMRE Financial Services were the companies that experienced the largest increase in the number of collections filed with the CFPB during the past 12 months. While the percentage increases may be substantial, the actual number of complaints may not be. In the case of Dynamic Recovery Solutions, the average number of complaints has increased to 19 from 11 a year ago.