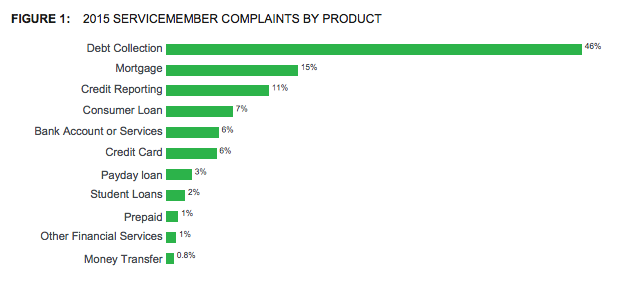

The Consumer Financial Protection Bureau has issued its annual report from the Office of Servicemember Affairs and the key takeaway is that servicemembers are filing complaints about debt collectors and collection-related activities at a rate that is twice as high as those filed by non-servicemembers. Nearly half of the 19,000 complaints filed by servicemembers in 2015 were related to debt collections.

One particularly interesting statistic is that many of the collection complaints are about medical debts, which is an area that is more likely to impact veterans than the general population. Of the complaints filed in 2015, 13% were for medical-related debts, according to the report.

One particularly interesting statistic is that many of the collection complaints are about medical debts, which is an area that is more likely to impact veterans than the general population. Of the complaints filed in 2015, 13% were for medical-related debts, according to the report.

The most common complaint is the continued attempt to collect debts that the servicemembers claim are not owed; in most cases the total amount of the debt is in dispute.

The report also details other areas of complaints filed by servicemembers, including those related to mortgages, other types of consumer loans, prepaid cards, and student loans. But the CFPB went out of its way to make sure that it indicated where the majority of the complaints are coming from.

“The complaints highlighted in today’s report show that members of the military continue to have serious problems when it comes to debt collection,” said CFPB Director Richard Cordray, in a statement. “The Bureau will continue to closely monitor complaints from servicemembers to ensure our brave men and women are getting the protection they deserve.

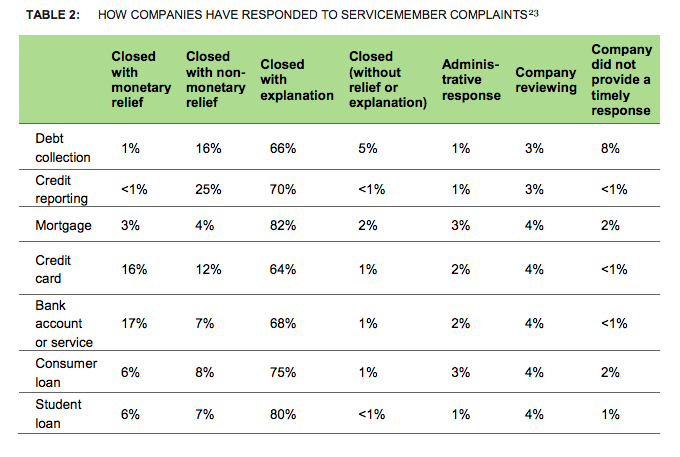

One area where debt collectors can stand to do a better job is responding to CFPB complaints. Of the categories monitored by the CFPB and its Office of Servicemember Affairs, debt collectors were, by far, the worst at responding to complaints in a timely fashion. Eight percent of the complaints were not responded to in a timely fashion, compared with 2% for mortgages, 2% for consumer loans, 1% for student loans, and less than 1% for the other categories. Only 1% of the complaints filed about debt collectors required some form of monetary relief to the consumer; compared with 16% for credit cards, 17% for bank accounts; 6% for consumer loans; 6% for student loans; and 3% for mortgages.

One area where debt collectors can stand to do a better job is responding to CFPB complaints. Of the categories monitored by the CFPB and its Office of Servicemember Affairs, debt collectors were, by far, the worst at responding to complaints in a timely fashion. Eight percent of the complaints were not responded to in a timely fashion, compared with 2% for mortgages, 2% for consumer loans, 1% for student loans, and less than 1% for the other categories. Only 1% of the complaints filed about debt collectors required some form of monetary relief to the consumer; compared with 16% for credit cards, 17% for bank accounts; 6% for consumer loans; 6% for student loans; and 3% for mortgages.