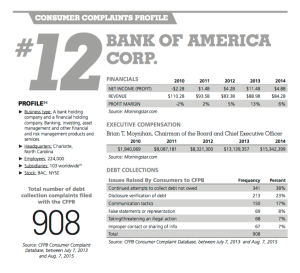

A non-profit advocacy group has released a report that profiles the companies in the Consumer Financial Protection Bureau’s consumer complaint database with the most collection-related complaints.

The list of companies profiled in the report are:

- Encore Capital Group, Inc.

- PRA Group, Inc.

- Enhanced Recovery Company, LLC

- Citigroup, Inc.

- Expert Global microsoft office 2016 Solutions

- Resurgent Capital Services L.P.

- Capital One Financial Corp.

- Synchrony Financial

- Convergent Resources, Inc.

- JPMorgan Chase & Co.

- Allied Interstate LLC.

- Bank of America Corporation

- Navient Corp.

- Dynamic Recovery Solutions, LLC

- Wells Fargo

The report looks at the complaints filed against each company, includes whatever ownership, financial, and company information that is publicly available, a summary of complaints filed with the CFPB against the company, any regulatory actions taken by state or federal regulators against the company, and lawsuit results involving the company. A sampling of the “company analysis” of PRA Group:

The report looks at the complaints filed against each company, includes whatever ownership, financial, and company information that is publicly available, a summary of complaints filed with the CFPB against the company, any regulatory actions taken by state or federal regulators against the company, and lawsuit results involving the company. A sampling of the “company analysis” of PRA Group:

PRA Group has obtained revenue through default judgments in lawsuits filed against consumers in the pursuit of time-barred “zombie” debt. SEC filings from 2013 reveal payments received on debt the company purchased as long ago as 1996. In 2014, PRA was made to pay $300,000 in civil penalties to the state of New York as part of a settlement for its violations concerning the pursuit of time-barred debt through default court judgments. In addition, the company was made to vacate thousands of judgments that the New York Attorney General’s Office called “improper.” According to an estimate by the Virginian-Pilot, PRA group is pursuing legal action on 1.5 million of its accounts, and nearly half of PRA Group’s collections came from legal action in late 2013. PRA Group has also been subject to legal action. A Missouri jury awarded one woman, who alleged long-term harassment, $250,000 for violations of the Fair Debt Collection Practices Act and almost $83 million in punitive damages. In September 2015, the CFPB announced a new enforcement action after finding that PRA Group, along with Encore Capital, “bought debts that were potentially inaccurate, lacking in documentation, or unenforceable.” The CFPB further found that PRA Group, “without verifying the debt, … collected payments by pressuring consumers with false statements and churning out lawsuits using robo-signed court documents.” Likewise, PRA Group was found to have “falsely claimed an attorney had reviewed the file and a law- suit was imminent,” when, in fact, attorneys allegedly had not reviewed files and the company had not decided whether to file suit. The CFPB enforcement action required PRA Group to pay an $8 million penalty, pay up to $19 million in consumer refunds, and stop collection on over $3 million worth of debts. The action further required PRA Group to overhaul its debt collection and litigation practices.

After all of the profiles, the report makes several recommendations to the CFPB about how it can further reform the debt collection process. Those recommendations are:

- Apply new debt collection rules to original creditors — which include payday lenders, credit card companies, and banks — along with third-party collectors and debt buyers.

- Strengthen remedies and increase penalties to enable consumers to stop abusive debt collection practices.

- Require debt collectors to have complete documentation (including information about the consumer, the debt itself, previous communications, and proof of the collector’s legal right to collect the debt) prior to initiating collection actions, and require debt sellers to furnish full documentation to future collectors of the debt.

- Set specific limits on phone calls from debt collectors to prevent harassment of consumers and ensure that consumer requests to cease communication are honored.

- Stop deceptive and abusive credit reporting practices by debt collectors.

- Stop unfair and abusive practices in the collection of medical debt.

- Protect student loan holders from abusive collection practices.

- Strengthen enforcement of the prohibition against debt collectors contacting third parties (such as employers and family members).

- Prohibit the sale, purchase, and collection of time-barred debt.

- In enforcement actions, levy penalties on a scale to serve as meaningful deterrents to prevent companies from engaging in unfair, deceptive and abusive debt collection practices.

The report notes that six of the 15 companies with the most collection complaints are creditors, and those companies should be subject to the FDCPA as third-party collectors are. As well, since the majority of complaints filed by consumers are over a debt that those consumers feel they do not owe, collectors should have a baseline of information before initiating any collection action. That baseline includes:

- Information about the consumer (including identifying information, primary language, receipt of exempt funds, disability status, con- ditions of financial hardship, military status, and whether or not the consumer is repre- sented by an attorney);

- Information about the debt itself (including original creditor; type of debt; account number; date of origination; terms and conditions; principal due; an itemization of fees, charges and interest; documentation of consumer responsibility; any settlement agreements or payment plans previously established; and information about the applicable statute of limitations);

- A record of previous communications (including all previous communications and attempts to collect payments on the debt, cease contact demands, previous disputes about the debt, and details about inconvenient times/places to contact the consumer);

- Proof of the collector’s legal right to collect the debt

To avoid harassing consumers, debt collector should be limited to calling consumers “no more than three times per week and no more than one conversation per week.” To avoid improper reporting of a debt to a credit bureau, creditors and collectors should also be forced to wait 120 days before reporting an unpaid debt to a credit bureau.