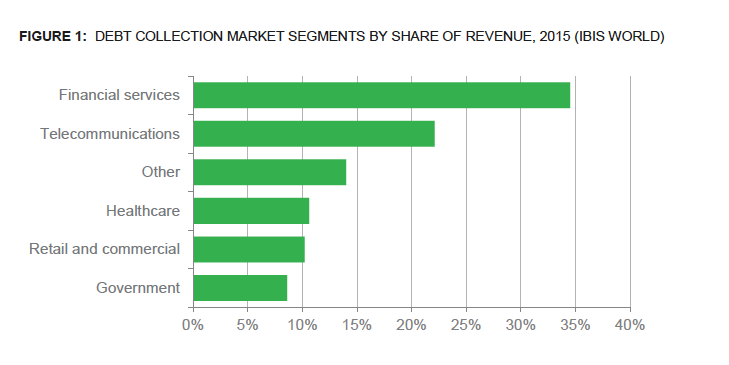

Financial services collections account for the largest percentage of the debt collection industry and credit card debt sales are concentrated among a handful of debt buyers, according to data published yesterday by the Consumer Financial Protection Bureau.

The data was part of the CFPB’s Consumer Credit Card Market Report, which offers a comprehensive assessment of the credit card market.

Delinquency and charge-off rates on credit cards have been steadily declining for the past several years. In fact, the 30-day delinquency rate is at it’s lowest point since the Federal Reserve began tracking the statistic in 1991. But the influx of new cards issued, when combined with the low delinquency and charge-off rates, offer the potential for a significant increase in default activity, according to the report.

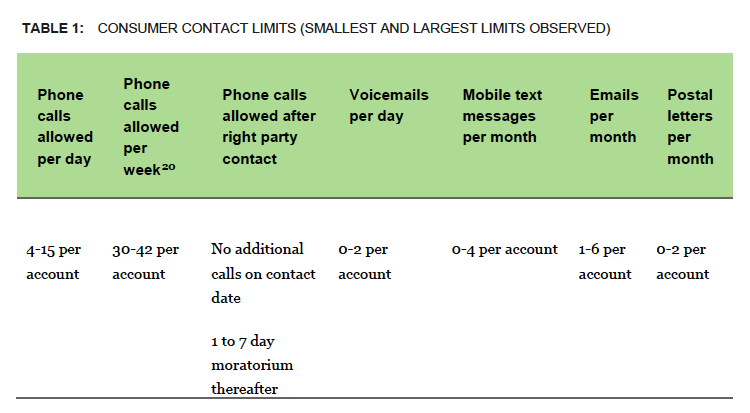

A survey of card issuers detailed a wide range of collection activities. While most collectors will only leave one voicemail per day, and will generally leave a debtor alone for a week after making contact, some collectors admitted to making as many as 15 attempts a day to reach a debtor. In general, card issuers start sending accounts to third-party collection activities only after an account has reach 60 or 90 days delinquency.

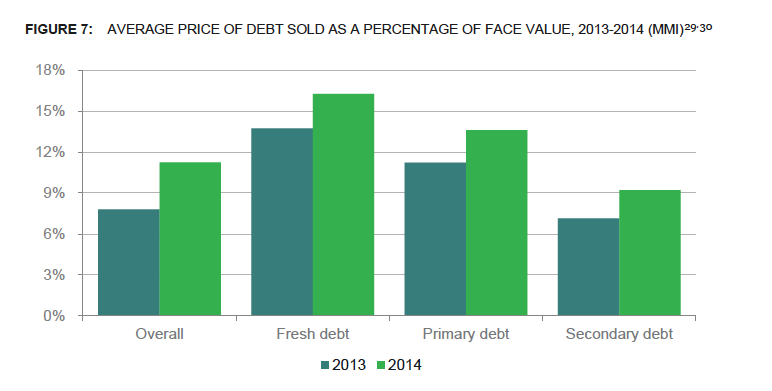

While issuance of credit cards is rising, debt sales of defaulted credit card debt are cratering. The amount of credit card debt portfolios sold has dropped to $19 billion, as of 2013, from $68 billion in 2007. According to the survey, only a small minority of companies sold debt portfolios in 2014, the last year surveyed. The volume of debt sold dropped 23% between 2013 and 2014, according to the report. What’s interesting is that only 30% of charged-off debt was sold to debt buyers, meaning that 70% of debt that has been charged off is just sitting somewhere, collecting dust. Even more interesting is that none of the card issuers surveyed indicated a likelihood of selling more debt and many indicated plans to sell less of it.