It seems fairly straightforward that the more people who complain about you to the Consumer Financial Protection Bureau, the more likely you are to get fined. But one company has gone out and quantified exactly how many complaints it usually takes and how much the fines are likely to be by analyzing the CFPB’s complaints database.

For example, the probability of being fined jumps tenfold – to 58% from 6% – when a company crosses the 2,000-complaint threshold. And the average fine for companies wth complaint totals between 2,000 and 10,000 is $134 million. When a company crosses the 10,000 complaint barrier, the average fine goes up to $758 million, according to data analyzed and published by PerformLine. For companies with fewer than 2,000 complaints, the average fine is $60 million.

There is also a seasonality component to when complaints are filed. The months between March and August have the highest number of average complaints, averaging in excess of 40,000 per month during that span.

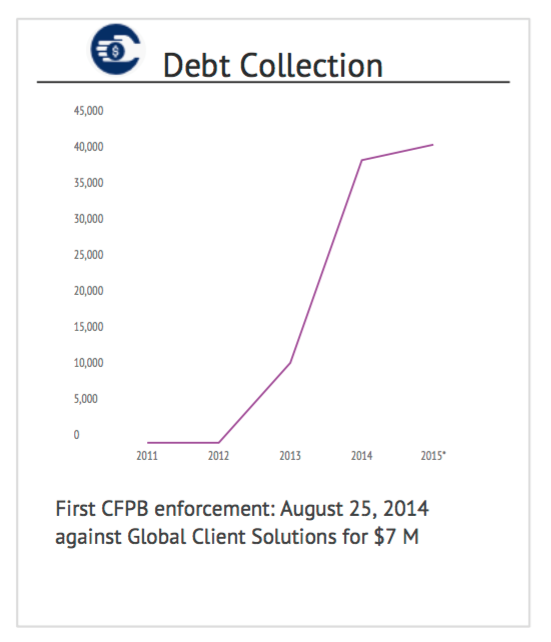

While ranking first for most of the time since the CFPB began accepting complaints in 2011, mortgage complaint totals have fallen off during the past three years and are now second to debt collection complaints.

A copy of the free report can be downloaded here.