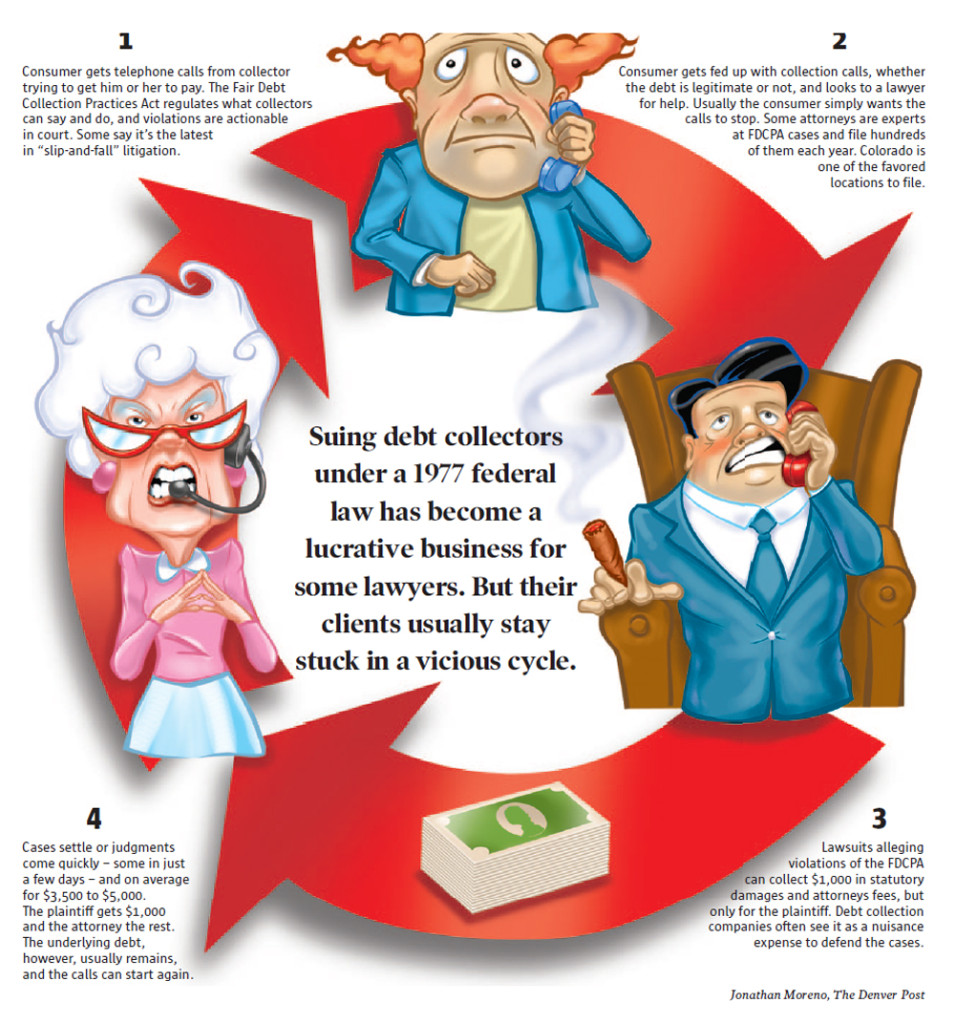

AccountsRecovery.net is proud to be partnering with WebRecon to publish a series of articles that will help shed light on the issues facing collectors when it comes to complying with laws such as the Fair Debt Collection Practices Act and the Telephone Consumer Protection Act, as well as defending themselves against complaints filed with the Consumer Financial Protection Bureau. WebRecon offers a free report that tracks consumers who are frequent filers of lawsuits. Know who the problem consumers are, before they sue you.

Generally, consumers are not happy to get collection calls. Feelings of embarrassment, anger, fear or some other emotion hang over calls like a dark cloud. But for some people, a ringing phone is the same as putting a worm on a fish hook. Those are the people whose objective it is to try and induce collectors to make a comment or do something they are not supposed to do so that a lawsuit can be filed. The industry is full of these “frequent filers,” people who repeatedly sue collection agencies. And the best way for them to find a reason for them to sue is to get a collector on the phone. It’s called call baiting and it’s a big problem for collectors.

Many agencies spend a lot of time and energy training their employees so that they try to avoid saying anything on the phone that they are not supposed to say. But the people who make a living out of suing are very good at what they do. And it takes something as simple as a consumer saying, “I don’t think I owe that much” for them to argue that they were disputing a debt.

“The good ones are very subtle,” said Kathy Zurek of Diversified Adjustment, a collection agency in Minnesota. “It used to be more blatant. You could hear people coaching them in the background or you’d be able to tell the consumer is reading from a script. But not anymore.”

Some of the more blatant attempts at baiting, especially in today’s environment, have to do with autodialers. If a consumer asks something like, “Are you calling me in an autodialer,” or “Will you report me to the credit bureaus?” those should be a red flag to a collector that this is not an ordinary collection call.

“Those people are not interested in a serious conversation,” said Scott Wortman, a partner in the law firm of Warshaw Burstein. “They are just trying to set you up for an FDCPA or FCRA violation.”

When debtors ask permission to record a call, that should be considered a red flag, too, said Anita Tolani, an attorney with the firm of Weinberg, Jacobs & Tolani.

To help its agents, Zurek developed an infographic that can be used to help discern whether a consumer is trying to set a trap on a phone call. But even then, it might not be enough.

“You can train collectors until you’re blue in the face, but this is how some consumers make their living,” Zurek said. “And it only takes one for you to have a problem.”

Collection agencies can help themselves avoid potential problems by scrubbing their call sheets and looking for consumers who file multiple lawsuits. Knowing who those people are in advance can provide an opportunity to make sure the call is handled properly, without any problem.

In the event of a problem, the collector should either end the call as quickly as possible or route the call to a supervisor, according to collectors.

“This is what supervisors are there for,” Wortman said. “Collectors shouldn’t take it upon themselves. They have training and there are procedures – they should follow it.”

Tolani added that it’s perfectly acceptable for a collector to say, “I don’t know” to a debtor during a conversation.

“It’s better to say ‘I don’t know’ than it is to say “I’m not permitted to answer that,’ ” she said.

One of the best strategies to avoiding lawsuits is following the golden rule, Wortman said.

“Treat people with compassion and integrity,” he said. “If the other person is being harrassing, there is no statute that says you have to take abuse on the phone.”

Given the ever-changing nature of rules and case law, and the evolution of technology, how an agency prepares and responds to call baiting must be a state of constant vigilance, Tolani said.

“Things are getting less and less acceptable and there are more and more things to worry about,” she said. “Where companies fail is by not updating their policies when there is new case law. Some of my very large clients are looking at their policy every day.”

Check out more about WebRecon by visiting www.WebRecon.com and click here to download the free Frequent Filers Report.