Some quick links to start your Tuesday. Auction prices for cars and trucks continue to move in different directions … They’re going to make a movie about the Volkswagen clean diesel scandal … An argument against college football … Getting out of debt is a top priority for millennials … This is truly the end of an era … How to grow your presence on social media … Two tips to cut your grocery bill in half … A list of the states you need to work 100 hours in to get by on minimum wage … All the places in the world where government has lost control … Economists expect less growth, rising interest rates … The states where people have the best and worst financial habits.

NEWS

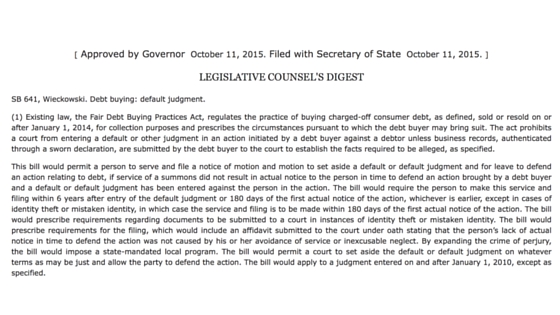

- The governor of California signed a bill into law on Friday that will also give consumers up to six years to defend or set aside a default judgment if they do not appear when sued by a debt collector. Debt buyers also must submit sworn records in order to obtain a default judgment.

- Is the Consumer Financial Protection Bureau helping consumers? That’s a question that has not really been asked – or answered – despite a lot of rhetoric and posturing on both sides of the debate. By looking at the companies that the CFPB has gone after – many of them considered to be the pillars of the banking system – and the unintended consequences of the bureau’s actions leads some to question if the CFPB is doing more harm than good.

- The state of Florida is trying to do more to get its residents better access to legal counseling and advice, especially those who are unable to afford lawyers. The state released a preliminary report yesterday saying that legal aid societies are only scratching the surface of meeting the needs of Sunshine State residents. For example, in one of the 20 judicial districts in Florida, 1,600 people represent themselves every month in civil matters, such as debt collection lawsuits.

- Is representing a collection agency such a bad thing? It appears to be in Kentucky, where one candidate for Attorney General is using his opponents work representing a collection agency as a black mark against his character.

- To be honest, I’m nit quite sure what’s going on here, but it felt like I needed to include it. It’s an article about the kinder, gentler ways that people can borrow and repay money, like from friends. And how those ties can bind people together in meaningful ways. The world doesn’t need big, bad financial institutions and debt collectors, just people who are kind and friendly.

Under Armor’s CEO talks about his birth as a salesman

Why hiring veterans is a good idea

If you have a tip or item you would like to share, or are interested in sponsoring the Daily Digest, please contact me at [email protected].