The Consumer Financial Protection Bureau has issued its second monthly complaint report, which analyzes trends in complaints filed by consumers with the regulator, and also spotlights one particular area of concern.

This month’s spotlighted area is credit reporting complaints, which were 56% higher in July than June, according to data released by the CFPB. Even with the huge jump, though, credit reporting could still not top debt collection as the most often-complained about category.

There were 8,224 complaints about debt collectors and collections in July, up 11% from a month earlier. It was the 23rd straight month that collections had topped the monthly list. Collection-related complaints accounted for nearly one-third of all complaints filed with the CFPB last month. Credit reporting came in second last month, with 6,696 complaints.

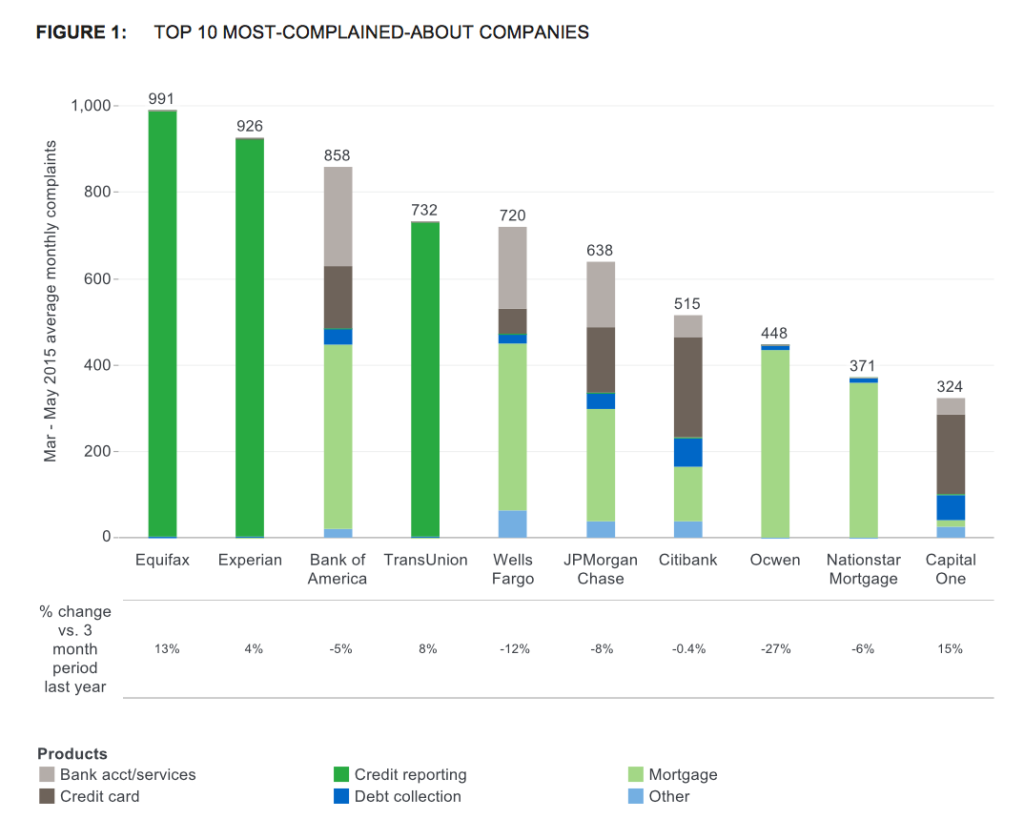

Mortgages remained as the overall leader for total complaints since the CFPB started collecting them, with 187,916. Debt collection complaints are second, at just over 170,000. But at their current rate, collections should overtake mortgages some time later this year.

California was the state with the most complaints, but the District of Columbia represented the state or territory with the highest per-capital complaint rate. More than 6 out of every 1,000 consumers in D.C. filed a complaint last month.

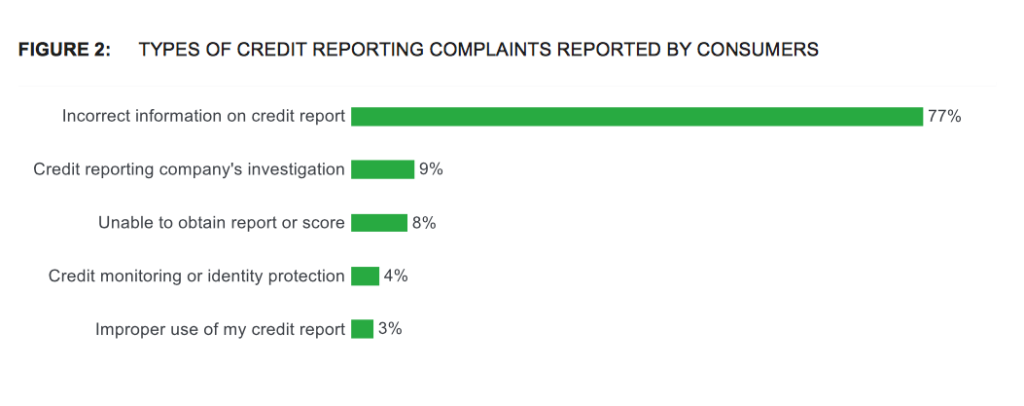

When it comes to credit reporting agencies, there is one major complaint that dwarfs all others.

For the complete report, click here.