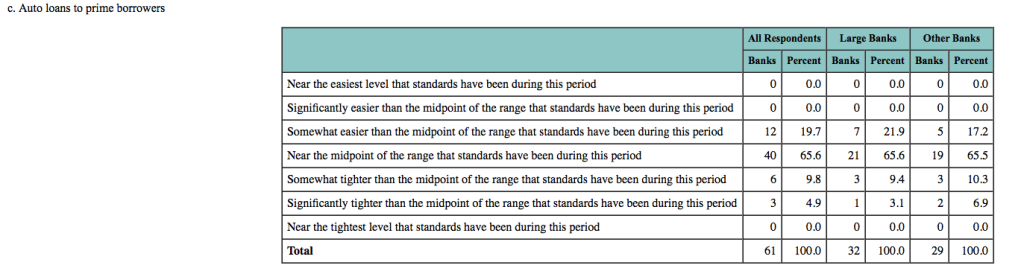

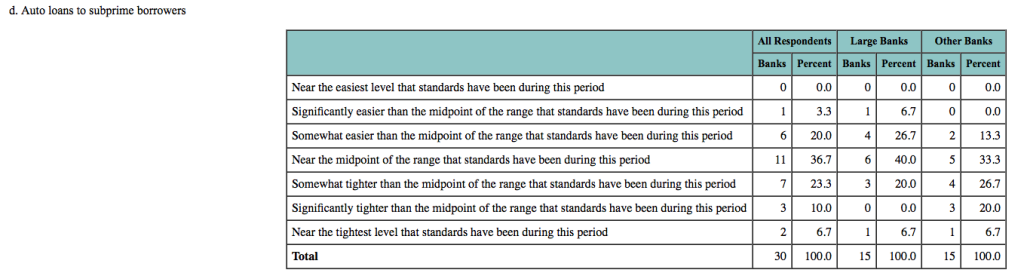

Auto lenders appear to be tightening their credit underwriting standards on loans to prime and subprime borrowers, according to a survey of loan officers conducted by the Federal Reserve Board.

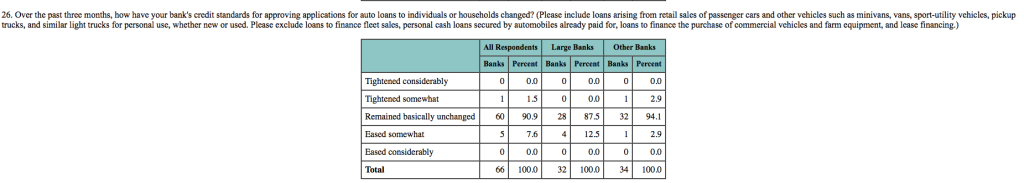

The Fed conducts the survey, of 80 domestic banks and 24 U.S. branches of foreign banks quarterly. What the most recent data suggests is that while the standards that banks are using to determine whether consumers qualify for auto loan financing were largely unchanged from a quarter ago, there are signs that more banks are making it harder for consumers to be approved. This normally happens when banks expect delinquency and default rates to increase. The tightening of loan standards means that only better-qualified borrowers – those who are more likely to make their payments – are approved for financing.

Banks appear to be tightening their underwriting guidelines on both borrowers with good credit and those with less-than-perfect credit.

Those institutions that participated in the survey also indicated stronger demand for car loans from borrowers, which is another good sign for the industry.

Some additional data charts: