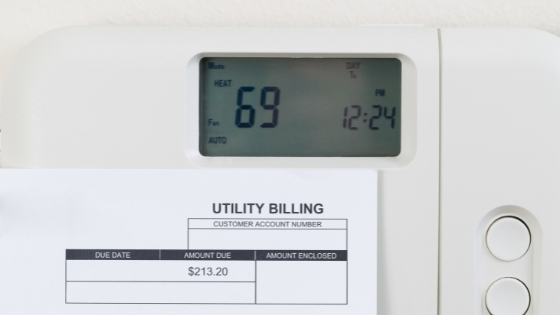

Rising Utility Debts Causing More Problems for Consumers

Companies in the accounts receivable management industry that collect on unpaid utility…

Encore CEO Not Worried About Recession’s Impact on Collections

There does not seem to be a lot of cause for concern…

Household Debt Keeps Growing, But Delinquency Rates, Volume of Accounts Placed with Agencies Increasing, Too

While consumers have weathered the current economic situation and the pandemic remarkably…

Financial Situation Getting Worse for Consumers; Study Details Debt Sources, Plans to Pay it Off

Nearly one-quarter of households in the United States have no emergency savings…

More People Having Problems Making Ends Meet: Survey

Three-quarters of individuals earning less than $100,000 per year say their earnings…

More Consumers Using BNPL For Everyday Purchases, Sending Up Red Flags

More consumers are using Buy Now, Pay Later offerings for everyday expenses…

How Different Segments of Population Are Using Credit Products

Credit cards remain the most popular and common debt product used by…

New Data Indicates More Consumers Struggling to Make Ends Meet

More than half of all consumers across the country are going into…

Economic Data Continues to Show More Consumers Struggling to Make Ends Meet

In yet another sign that consumers are struggling financially, the number one…

More Families Making Financial Sacrifices After Child Tax Credits Expire

The expiration of child tax credits that were put in place to…